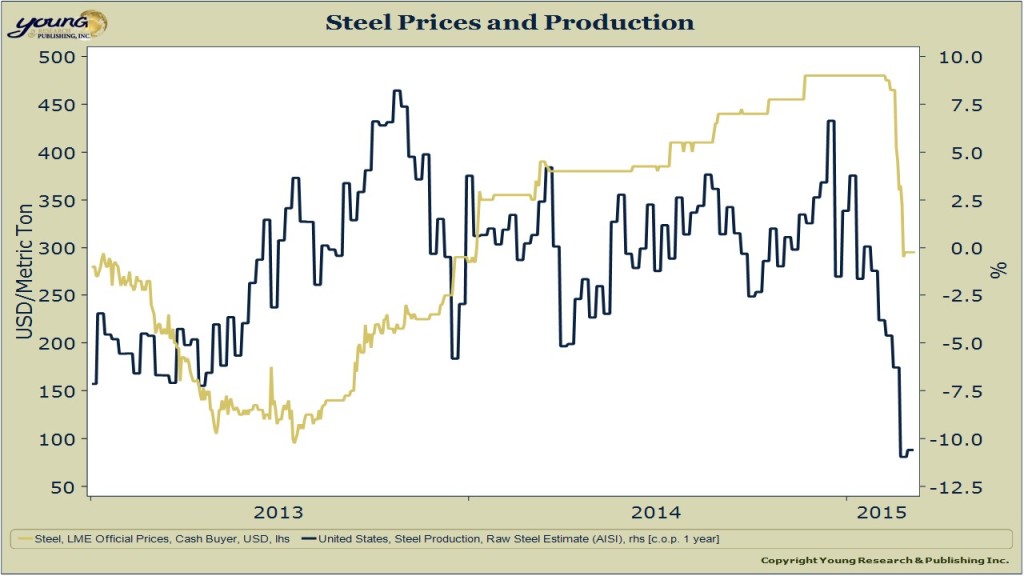

Oil isn’t the only commodity affected by strong dollar economics. While the strong dollar has been a boon to consumers in the U.S., commodity producers are facing competitors in countries with weaker currencies who can now offer lower prices. You can see on the chart below that U.S. steel production has plummeted along with London Metal Exchange prices for steel in dollar terms. The U.S. is now importing more steel, with 2014 imports from Russia and China jumping by 96% and 69% respectively.

Latest posts by Young Research (see all)

- Imagine If You Could Turn Water into Gold - April 26, 2024

- Tesla’s Charging Station Adaptation - March 6, 2024

- Can $7 Trillion End AI Chip Scarcity? - March 1, 2024