Javier Blas of Bloomberg reports that the rights to an offshore field containing 11 billion barrels of oil are at stake in an arbitration dispute. Blas writes:

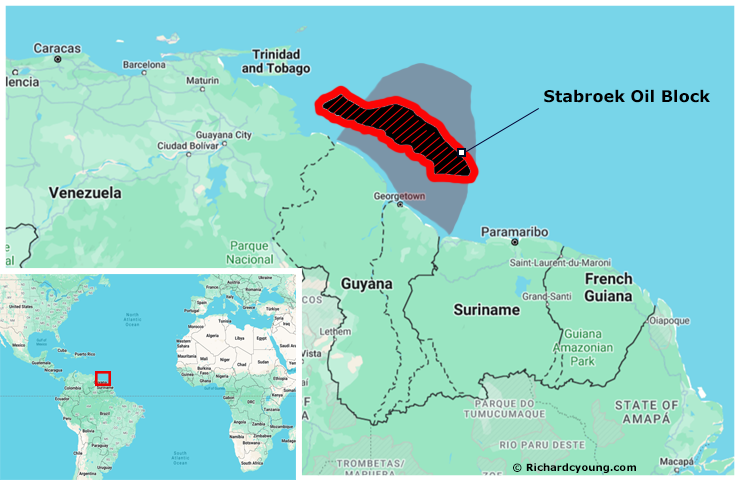

The prize is called Stabroek — a series of oil fields off the coast of Guyana, the Latin American nation bordering Venezuela and Brazil. The potential riches are incredible — about 11 billion barrels of oil, worth nearly $1 trillion at current prices. And Stabroek is now at the center of a legal battle that hinges on the meaning of a few words contained in a secret document, probably about 100 pages long. The outcome will reshape Big Oil.

ExxonMobil Corp. owns a large chunk of Stabroek, having been part of the consortium that found oil there in 2015. Chevron Corp. is now trying to muscle in, after announcing a deal in October to buy Hess Corp. in an all-stock transaction worth $60 billion, including debt. Hess is a partner in Stabroek, owning 30% of the block. Exxon is the operator, controlling 45%, and Chinese state-owned giant CNOOC Ltd. owns the remaining 25%. […]

Without access to the actual JOA document, which neither party has made public, we can only theorize about the legal arguments and potential outcomes based on the template the companies used to write it. But one thing is clear: it’s a nasty fight — one that will remake either of the participants. If Chevron wins, it would secure an expansion of its production beyond the US and its prized assets in Australia and Kazakhstan, helping to boost its valuation. But if Exxon prevails and finds a way to increase its stake in Guyana, it would consolidate its dominance over what many in the industry consider the most significant oil discovery of the last 25 years. For the future of Big Oil, there’s a lot at stake.

Read more here.