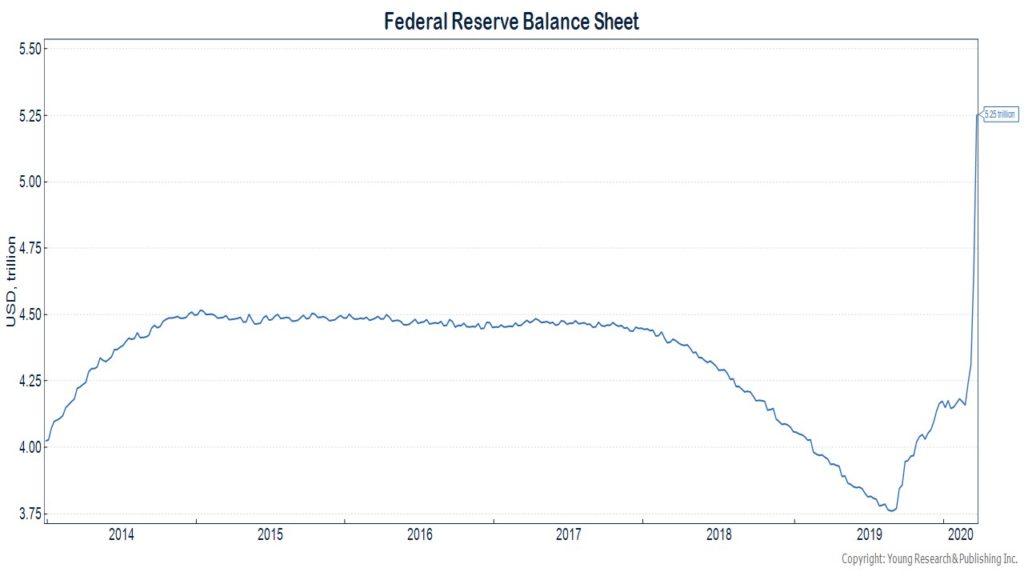

Below is a chart of the Federal Reserve’s balance sheet. The Fed has gone into money-printing overdrive. Over the last month, the central bank has conjured over $1 trillion out of thin air to buy Treasury bonds and mortgage-backed securities. The Fed is printing at a pace of up to $125 billion per day.

Once the stimulus passes, the Fed will be given about $500 billion in capital that can be leveraged up to 10X to buy more assets. The source of that leverage is newly printed money. We are talking about an additional $4.5 trillion.

Meanwhile, the Federal Government is likely to run a deficit of over $3 trillion this year.

Who is going to buy all those Treasury bonds that need to be issued to finance the spending?

The Fed, of course.

Maybe this all works out, but in case it doesn’t, continuing to hold some gold in your portfolio is prudent.