It turns out that among China’s 1.3 billion people, there are enough gold bugs to move the market. The newly affluent Chinese are driving a demand increase for the yellow metal. According to the South China Morning Post, China will overtake India this year as the world’s largest gold bullion consumer. The SCMP quotes Zhang Yongtao, vice-chairman of the China Gold Association, as saying, “We saw some frenzied buying following gold’s rout in April and our preliminary estimate confirms that consumption reached about 137 tonnes, more than double a typical month. Chinese demand for gold will remain robust because people are getting wealthier and investment choices are limited.”

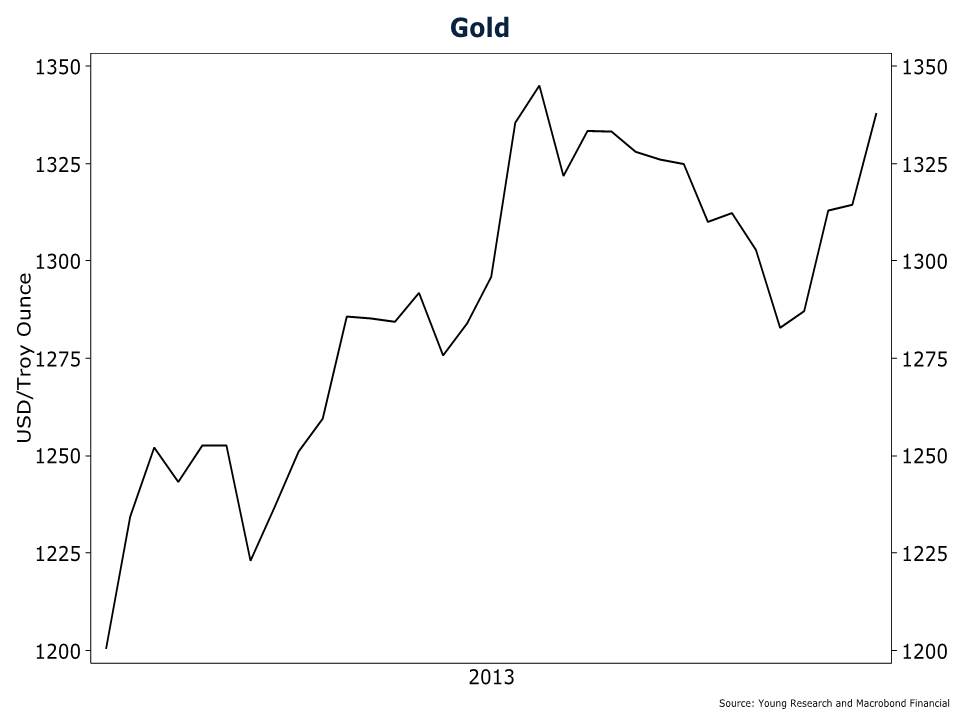

As you can see on the chart below, since gold’s June low, prices are up 11.5%.

In India, demand is so hot that the government has stepped in to tamp down gold buying. Last year demand for gold was 860 tonnes, and so far this year India has imported 536 tonnes. Import restrictions look to limit that importing to 200 tonnes. Reuters reports that smuggling is already underway, and that jewelers expect chaos in the gold market in India as the wedding season approaches.

Nearby countries are already experiencing a wave of increased gold imports as gold is brought close by to India for smuggling. Reuters India reports that Pakistan has placed a ban on gold bought to make jewellery for export already, and other countries are planning their own measures.

There are signs now that Indians may be bringing in gold through neighbouring countries, pushing their imports sharply higher as well and prompting action by their governments.

Pakistan has slapped a one-month ban on gold bought to make jewellery for export after its imports jumped 386 percent in the first half and topped $514 million in July alone – more than double what it bought in the first six months of 2012.

“The difference in import duties seems to have provided the incentive for increased duty-free imports in Pakistan and smuggling to India,” a statement on the finance ministry’s website said.

The Pakistan government will look at steps to quickly get rid of these loopholes, the release on the website added.

Sri Lanka imposed a 10 percent import duty on gold at the end of June to stop an arbitrage opportunity with India amid what one official called “leakages”.

Sri Lanka’s imports of gold jumped 46.7 percent from a year ago to $110 million in the first four months of this year. It imported gold worth $50 million in April alone, provisional data from the central bank showed.

International gold prices rose about 8 percent in July, their biggest monthly jump since January 2012, while India’s domestic prices rose about 9 percent during the month.

The curbs on imports are prompting the smuggling because they have created a premium price for gold inside India’s borders that Bloomberg reports could increase to $100 per ounce if he rules aren’t eased. Jewelers are already asking the government to ease the import restrictions.

The shortage cut the capacity utilization of jewelry units to about 50 percent, said Soni. The industry employs about 20 million artisans, he said.

“We are requesting the government to relax the import norms otherwise the whole industry will collapse and joblessness will increase,” said Soni. “We have requested the finance minister to consider a proposal to encourage use of idle gold lying in households. This will reduce imports.”

The Indian policy seems unsustainable, and could very well end up being repealed. Gold demand is high across the emerging markets, where newly affluent buyers are eager to splurge on gold jewelry and bullion.