Other than what someone’s willing to pay you, where does a cryptocurrency’s value come from? Because when it comes to sources of value, with dividends from stocks and interest from bonds, you know where you stand. With cryptos, you hope someone doesn’t jump the line.

When a company pays you a dividend (or a bond pays you interest), it worries about meeting its obligations to you. It sees you, unlike the anonymity of cryptos, banging your tin cup on the boardroom table saying: “Show me the money.”

When a company issues stock, it’s giving up ownership, and with a bond, it’s taking on debt. The company doesn’t care who owns the stocks or bonds—they just want to know where to send the checks.

Your Survival Guy’s noticed how stock and bond prices have been uncharacteristically out of synch for the first time in fifteen years (also pointed out in the WSJ). Investors are worried about inflation. And based on the hubris from the Fed, not everyone’s sure this ship will be docked without a scratch. Make sure your boat isn’t in the way. James Mackintosh reports on those worries in the WSJ, writing:

We saw this last week, with stock prices and bond yields moving in opposite directions every day. The link between the two, measured as the correlation of their daily changes over the past 100 days, is the lowest in more than 15 years. Instead of more inflation being good news for stocks, it is now bad news—while still being bad for bonds, meaning higher yields. Less concern about inflation now means lower Treasury yields, and higher stock prices.

Remember, capital structure is like a channel marker, guiding a company’s financial obligations. As a bondholder, you’re a bosun, senior to the average, stock, deckhand. The capital structure of a crypto? Who owes you anything if the system breaks down? No one.

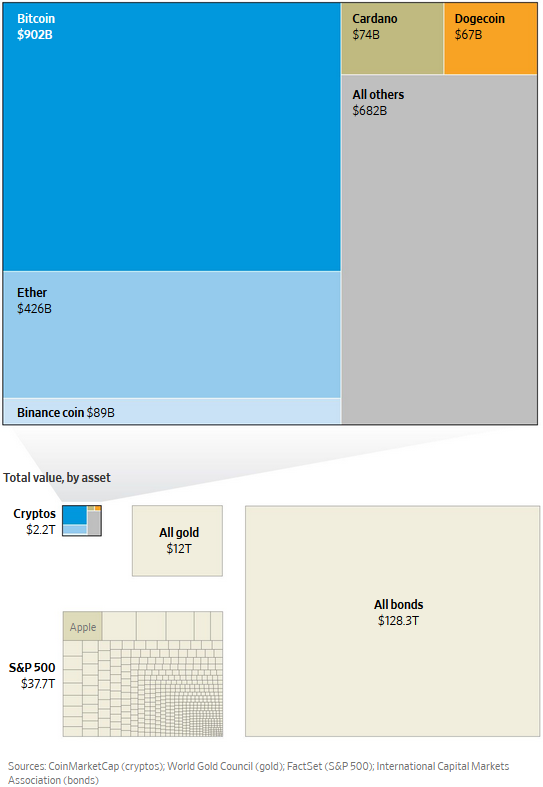

Action Line: Take a look at the market cap of cryptos, stocks, and bonds, and see why there’s plenty of smart money in bonds. Because at the end of the day, your return to port, like the return of capital, matters more than the return on it.

The Wall Street Journal explains the current situation with cryptocurrencies, writing:

Crypto in Context

Thanks to the prolific rise of bitcoin, ether and dogecoin, the value of the total cryptocurrency market has swelled to more than $2 trillion, up from $260 billion a year ago. Dogecoin alone—with a market value of about $67 billion—is worth more than 75% of the companies listed in the S&P 500. Although the digital currencies have surged in recent months, as an asset class, they remain a fraction of global markets for stocks, bonds and gold.

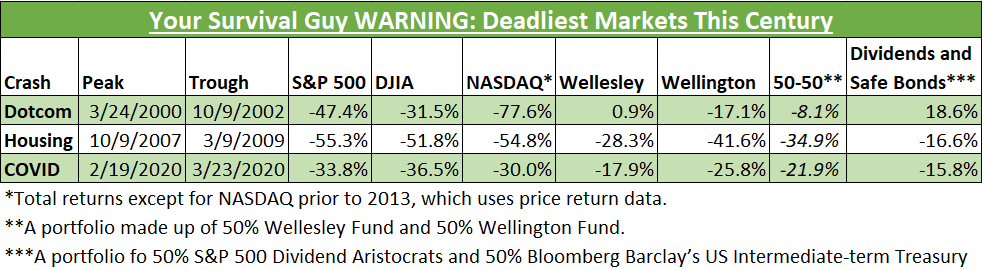

P.S. And remember, we’ve seen some troubling times thrice already this young century.

Originally posted on Your Survival Guy.