Monday was the centennial of the Federal Reserve. Established in 1913 as a lender of last resort, the Federal Reserve has taken on more and more responsibilities over time. Today it is expected to stabilize the value of the dollar (which it has failed miserably to do, with exceptionally bad performance noted during the 1970s), promote growth, produce full employment (ostensibly by ignoring the value of the dollar), regulate banks, manage asset bubbles (though the Fed seems better at creating them), and to communicate all of this with a stream of speeches, press conferences and articles seemingly written to confuse the hell out of the American public.

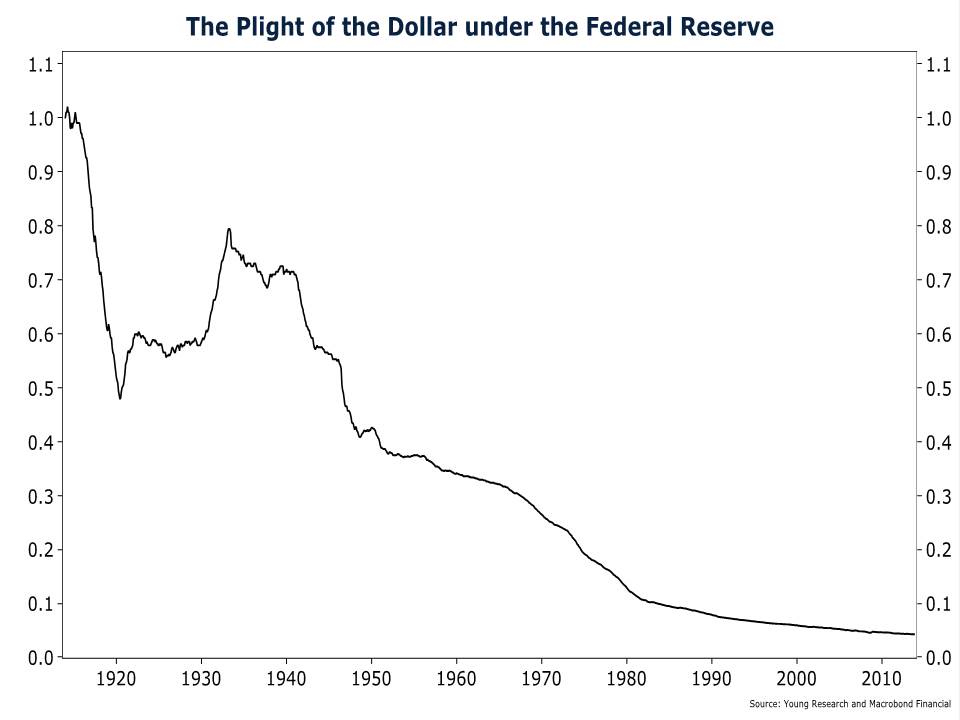

Take a look at the chart below of the value of the dollar since 1913. As you can see, the Fed’s goal of price stability is nowhere in sight. Today’s dollar is worth a mere $0.043 in 1913 terms. In reverse that means a 1913 dollar today would be worth $23.31. That’s enough to buy a decent sit-down lunch in most cities in America. Today’s dollar wouldn’t even cover the tip!

Trend growth has declined, labor force participation seems to be on a permanent retreat, bank regulation doesn’t seem to be any more efficient or effective than it’s ever been (perhaps it’s worse), and the Fed appears to be inflating a bubble in the stock market without any heed to warnings of its existence. Of its major stated goals and obligations the Fed doesn’t seem to have achieved any. Here’s to another 100 years!