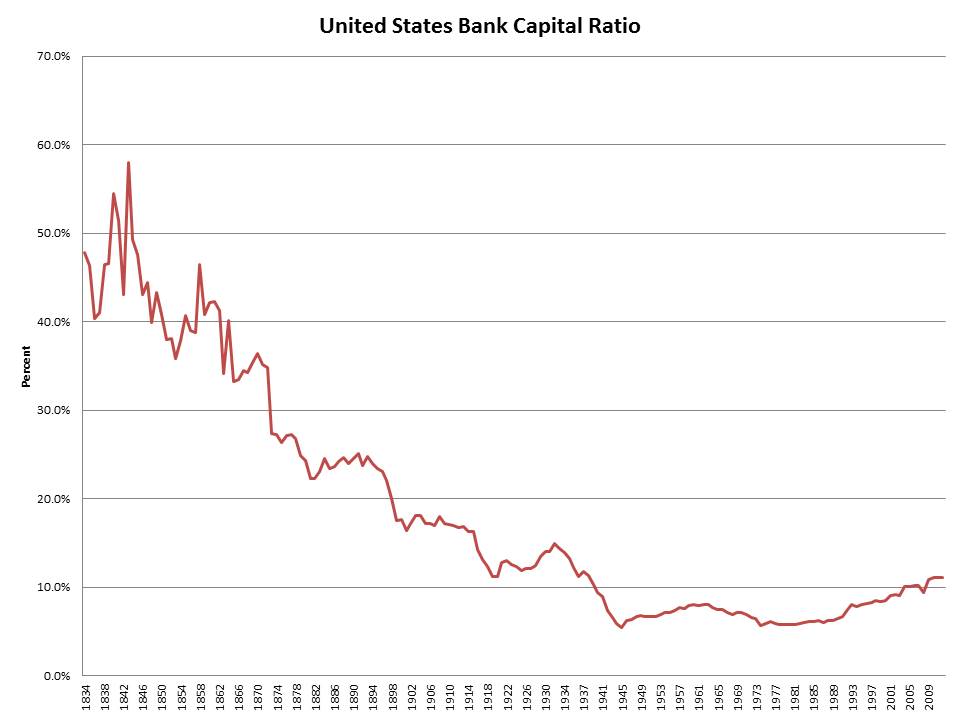

Long before Basel meetings and the Federal Reserve, America’s banks had figured out the bank capital ratios that worked best for them. In 1834 that was 47.7%. Today, even in generous risk adjusted terms bank capital ratios are low at 11.1% historically according to the FDIC. A common criticism of economic policies during the 1800s was that recessions were deeper and more frequent. That may be true, but they were also faster and periods of growth were stronger. The long, drawn out recoveries we see today could be a result of over-leveraging and too little bank capital—drawing too much of future growth into the present—preventing rapid takeoff. Higher bank capital ratios could speed up economic recoveries.

BOE Monetary Policy Committee Member David Miles Argues for More Bank Capital

David Miles of the Bank of England has recently given support to the idea of higher capital ratios. Miles rebutted the idea that higher capital ratios hurt economic growth saying:

In the UK and the US banks once made much greater use of equity funding than they do today. But during that period, economic performance was not obviously far worse and spreads between reference rates of interest and the rates charged on bank loans were not obviously higher. This is prima facie evidence that much higher levels of bank capital do not cripple development, or seriously hinder the financing of investment.

Conversely, there is little evidence that investment or the average (or potential) growth rate of the economy picked up as leverage moved sharply higher in recent decades. Figure 1 shows a long-run series for UK bank leverage (total assets relative to equity) and GDP growth. There is no clear link. Between 1880 and 1960 bank leverage was – on average – about half the level of recent decades. Bank leverage has been on an upwards trend for 100 years; the average growth of the economy has shown no obvious trend.