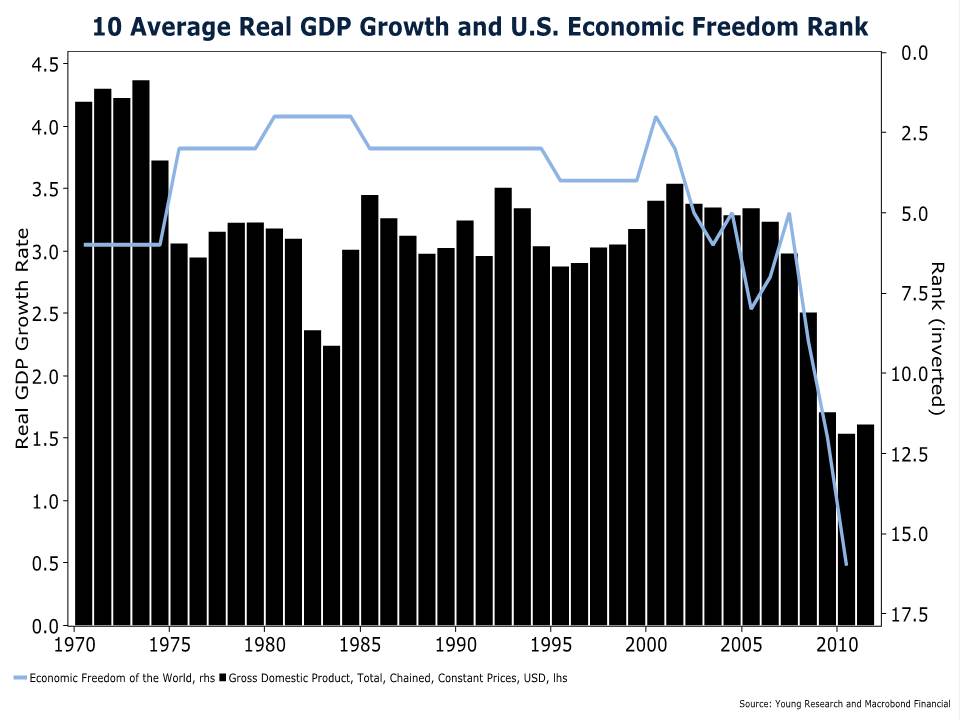

Real GDP growth has been declining in the United States for decades. As more rules and regulations have been placed on American business, it has become harder to generate meaningful real growth levels.

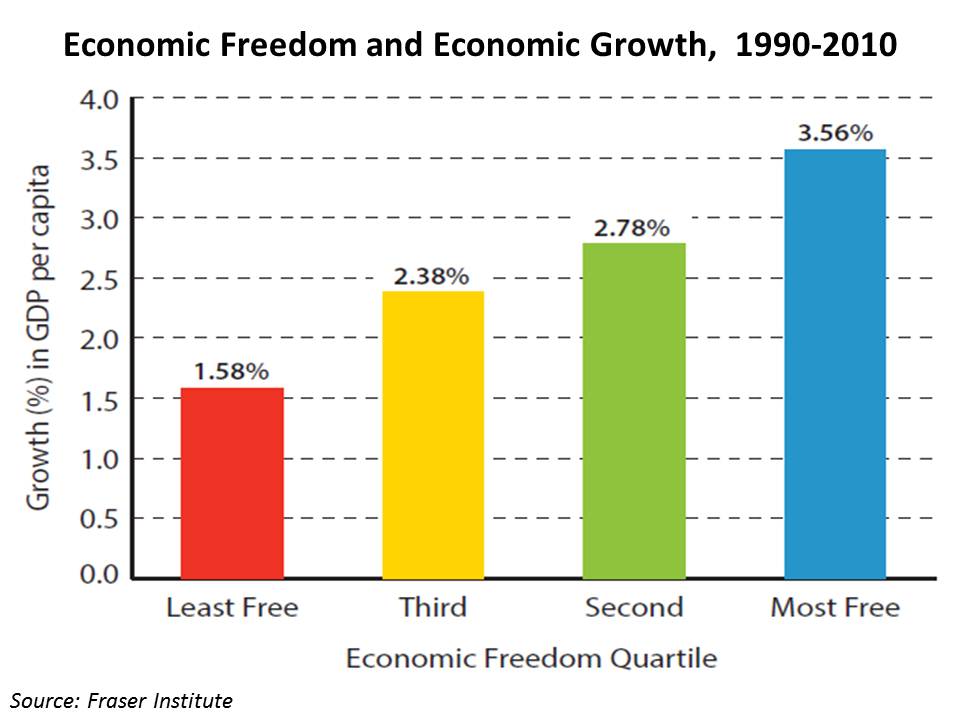

The Fraser Institute has found that, around the world economic freedom and growth are related. Those countries with the freest economies grow the fastest, and those with the most restricted economies grow the least. The chart below shows the Fraser Institutes’ Freedom of the World 2012 Report analysis of how economic freedom impacts GDP growth. It’s easy to see on the chart that the quartiles are unambiguously skewed towards faster economic growth in countries that have greater economic freedom.

What is most disturbing about the analysis is the trend of the United States during the last thirty years. Economic freedom in the U.S. continues to decline. The Fraser Institute summarizes the decline as precipitous.

The United States, long considered the standard bearer for economic freedom among large industrial nations, has experienced a substantial decline in economic freedom during the past decade. From 1980 to 2000, the United States was generally rated the third freest economy in the world, ranking behind only Hong Kong and Singapore. After increasing steadily during the period from 1980 to 2000, the chain-linked EFW rating of the United States fell from 8.65 in 2000 to 8.21 in 2005 and 7.70 in 2010. The chain-linked ranking of the United States has fallen precipitously from second in 2000 to eighth in 2005 and 19th in 2010 (unadjusted ranking of 18th).

You can see on the chart below that as GDP growth has declined at the same time that the rank of the U.S. in the Fraser Institute’s Economic Freedom Index has disappointed. The rank has fallen from 2nd or 3rd for most of the eighties and nineties to 16th in 2010. That’s terrible news for U.S. competitiveness and the prospect of real GDP growth.