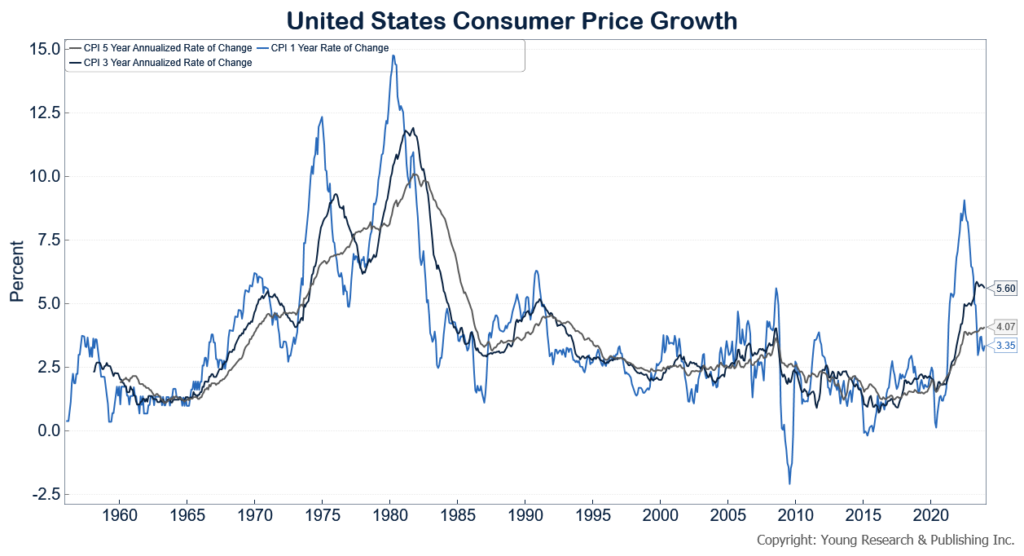

Sam Goldfarb and Nick Timiraos of The Wall Street Journal report that consumer prices rose 3.5% in March, and underlying price pressures remained strong. They write:

Stubborn inflation pressures persisted in March, derailing the case for the Federal Reserve to begin reducing interest rates in June and raising questions over whether it can deliver cuts this year without signs of an economic slowdown.

The consumer-price index, a measure of goods and services prices across the economy, rose 3.5% in March from a year earlier, the Labor Department said Wednesday. That was a touch higher than economists had forecast and a pickup from February’s 3.2%. So-called core prices, which exclude volatile food and energy categories, also rose more than expected on a monthly and annual basis.

Stocks fell, with the Dow Jones Industrial Average down more than 400 points to its lowest close in nearly two months. Yields climbed on U.S. government bonds, reflecting bets that the data could help delay and diminish future interest-rate reductions. […]

Surveys suggest that Americans remain frustrated by the cost of living. Indexes of consumer sentiment have gradually improved but remain well below prepandemic levels. A recent Wall Street Journal poll of voters in seven of the most competitive states in the 2024 election found that 74% thought that inflation had moved in the wrong direction over the past year.

Read more here.