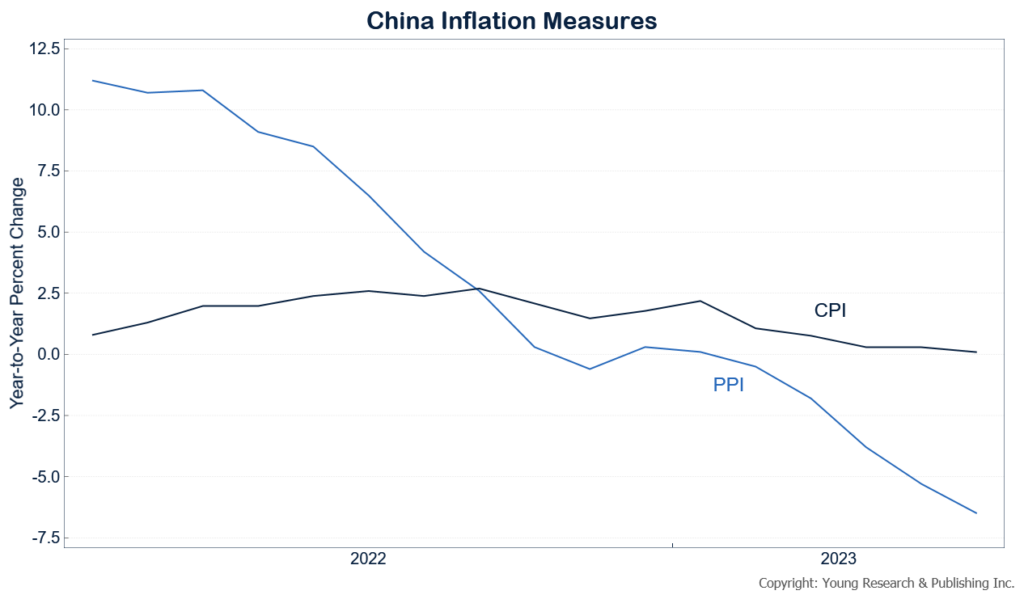

Chinese producer prices fell 5.4% from a year ago, and consumer prices have been flat. Will deflation overtake China’s consumer economy? Stella Yifan Xie reports for The Wall Street Journal:

China’s consumer inflation flatlined in June after two months of meager growth, stirring fears among economists and investors that the world’s second-largest economy is on the verge of slipping into deflation.

The country’s manufacturing sector, already in the grip of deflation, saw factory-gate prices fall at their fastest pace in more than seven years, the National Bureau of Statistics reported on Monday, reflecting soft demand abroad to match the weak demand at home.

The data is the latest evidence of the twin toll on the Chinese economy of a stalled post-reopening recovery in China and interest-rate hikes by central banks in the West that have curtailed consumer spending.

Economists worry that the broad-based decline in prices will weigh on already fragile confidence in the country, leaving the economy stuck in a vicious cycle whereby weak demand and lower prices reinforce each other.

“China certainly faces major deflationary pressure,” said Larry Hu, chief China economist at Macquarie Group, who warned of a downward spiral if expectations of deflation become entrenched.

Declining prices in China can offer a measure of relief for central bankers battling inflation in the U.S. and other developed economies. Lower prices for goods charged at the factory gate in China translate into lower import costs on Chinese goods for retailers in the West, while subdued consumer inflation also curbs China’s appetite for commodities from iron ore to crude oil, all of which helps to rein in inflation elsewhere, economists say.

Read more here.