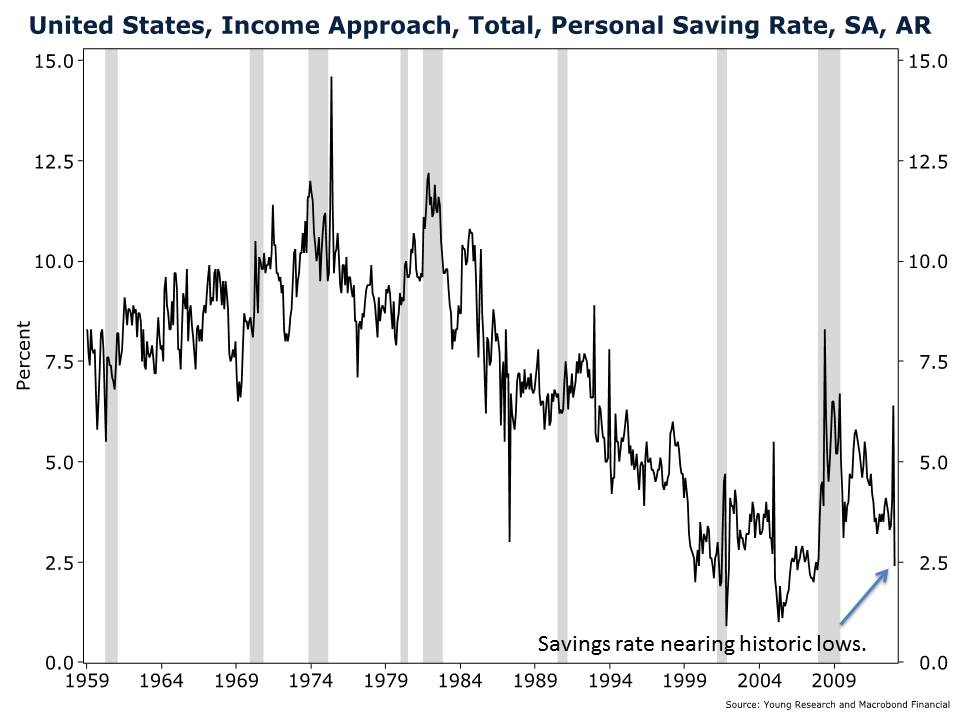

Seasonally adjusted retail sales recorded a 1.1% increase in February. The problem with the increase is where the money came from. As you can see in the chart below, Americans drove their savings down to the lowest levels since November 2007 to finance their spending. In a recovery that has relied heavily on the consumer to pick up the slack, once those saving are spent, where will growth be generated? With lending standards still very strict it won’t be from borrowing. Lenders aren’t keen on handing out money at today’s low rates to borrowers who have less ability to repay. Perhaps if rates adjusted to their natural levels banks would lend more, generating investment and consumption to fuel the economy. Meanwhile at the Federal Reserve, the only solution is lower interest rates to drive up asset prices to create a faux wealth effect. Perhaps instead, the Fed should adopt policies that generate actual wealth.

You Might Also Like:

Latest posts by Young Research (see all)

- Imagine If You Could Turn Water into Gold - April 26, 2024

- Tesla’s Charging Station Adaptation - March 6, 2024

- Can $7 Trillion End AI Chip Scarcity? - March 1, 2024