Unemployment is running at over 13%, but much of the economic data is coming in better than economists have been forecasting. And the stock market is down only modestly for the year in the face of what looks like a dire economic situation.

What’s driving the disconnect?

The personal income statistics from the Bureau of Economic Analysis may shed some light.

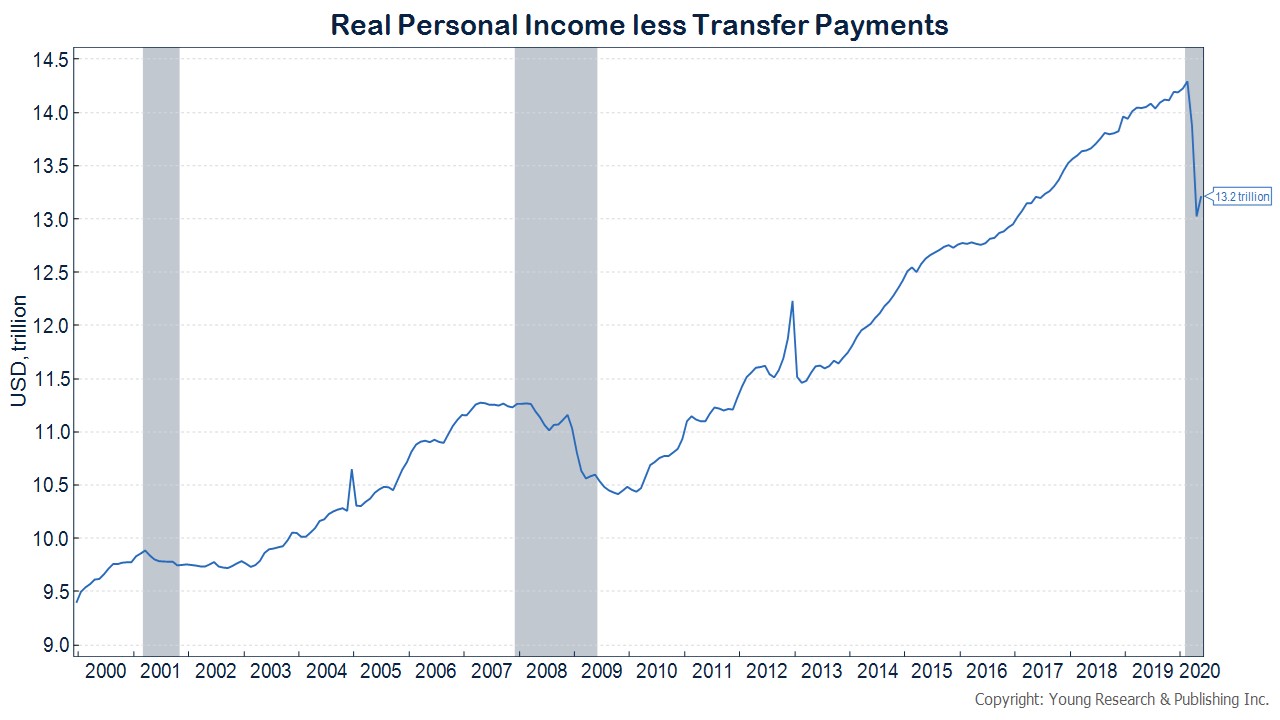

The chart below shows the level of after-tax personal income for the U.S.

In most recessions, after-tax income falls or if there isn’t an outright decline, there is a significant slowing in the rate of growth.

But not in this recession.

Instead of COVID causing a crash in after-tax income, it has resulted in the biggest two-month increase on record.

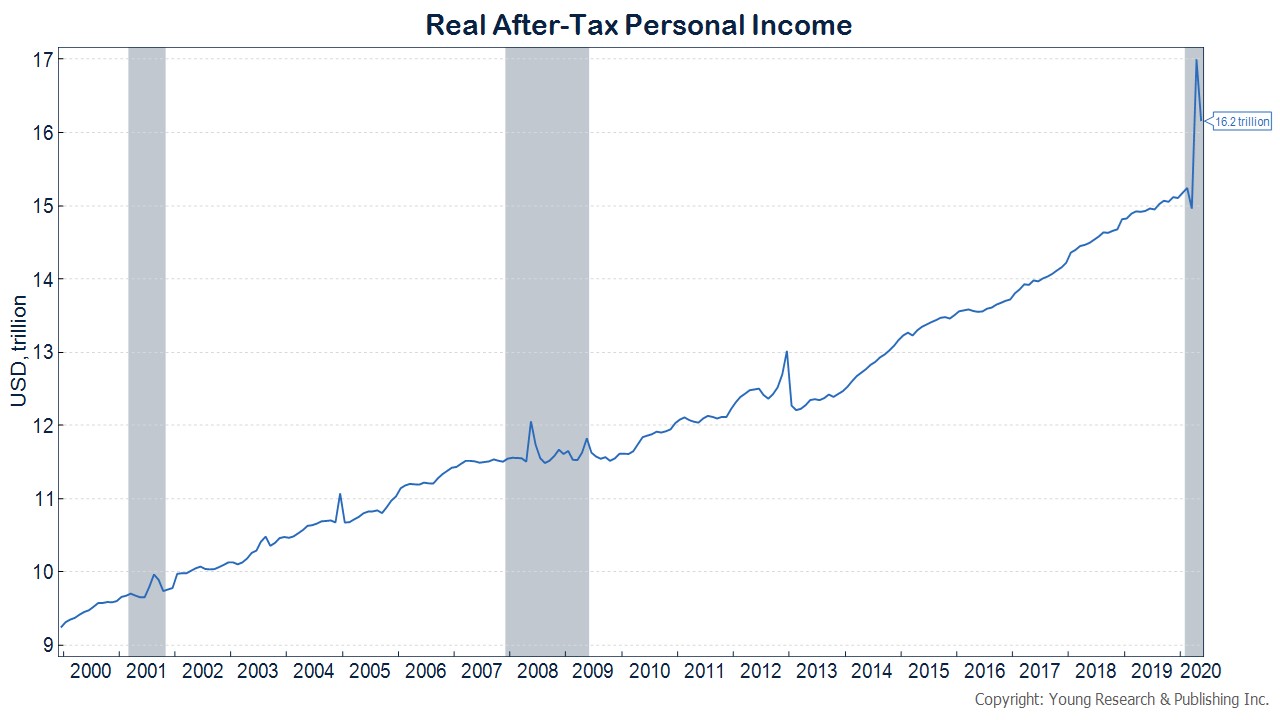

Where did all of that extra income come from?

Uncle Sam went on a spending spree (financing courtesy of Jay Powell).

Regardless of where the additional income came from, it’s money in the pockets of consumers and businesses. Money that has made its way into the stock market, and is starting to make its way into consumer and business spending.

Flush with stimulus checks and unemployment benefits that pay more than many full-time jobs, many Americans haven’t yet felt the economic pain from crashing business activity.

Yet being the operative word. The problem arises when the windfall runs out. The second chart below shows pre-tax personal income minus transfer payments. Take the government out of the equation and the situation looks a lot uglier.