Which Wins? Dividends or Buybacks?

CNBC reports that dividends are beating buybacks:

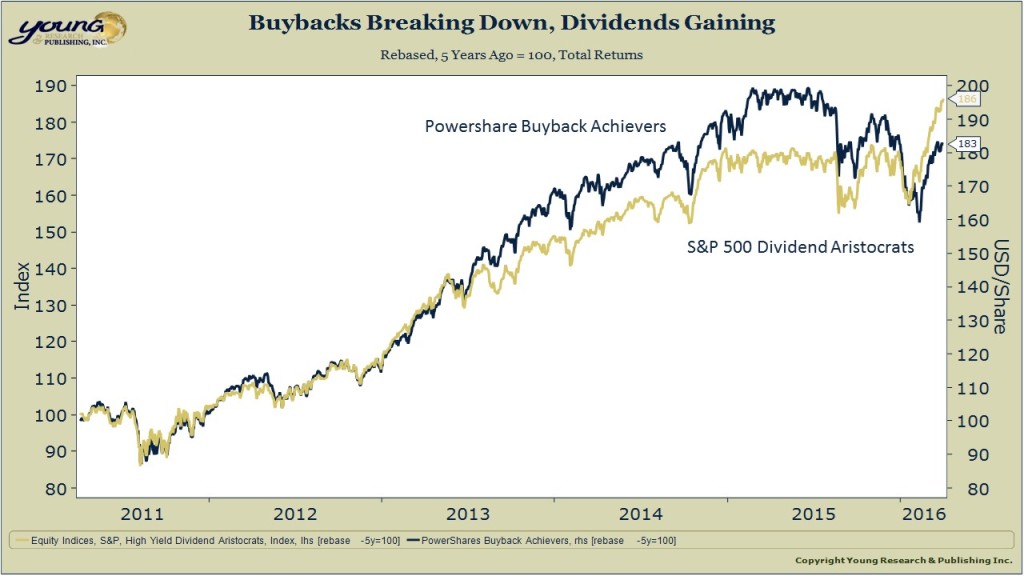

The PowerShares Buyback Achievers ETF (PKW), which tracks U.S. companies that have repurchased 5 percent or more of their outstanding shares over the past 12 months, is flat this year, underperforming the S&P 500. Meanwhile, the iShares Select Dividend ETF (DVY), which follows stocks with consistently high dividend yields, has risen 9 percent in 2016.

VIDEO: Dividend Payers are Crushing Big Buybackers

Buybacks the Easy Street for Management

Bloomberg writes:

In 2014, nonfinancial companies returned almost $1 trillion in the form of share repurchases and dividends. As a percentage of gross domestic product, that’s among the largest payouts on record. Besides pumping up bonuses based on stock prices, the payouts have brought many benefits for CEOs. They make it easier to meet quarterly earnings-per-share targets, by reducing the number of shares.

Buybacks Breaking Down, Dividends Breaking Out