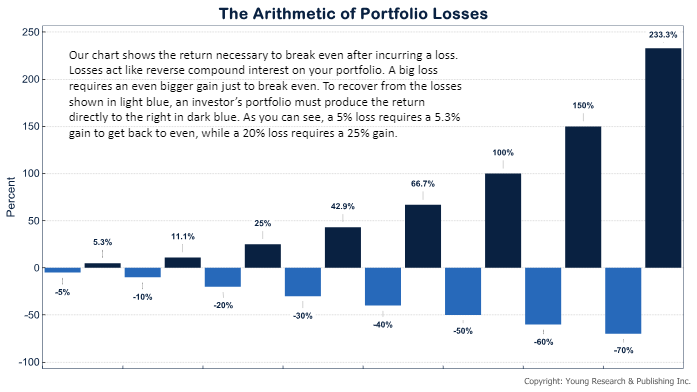

You simply cannot afford to take heavy losses in or near retirement. From a financial standpoint the arithmetic of losses is devastating—lose half your portfolio and you need a 100% gain (not likely) to get back to even.

Now, a study has been done to show the impact of losing money on one’s health. And it’s not good.

“Published last month in the Journal of the American Medical Association, [Lindsay Pool of Northwestern University] investigated how losing one’s life savings in the short term might curtail one’s lifespan in the long term,” writes the WSJ’s Susan Pinker.

Every two years, from 1994 until 2014, the federal study’s investigators called each subject looking for any change in their status and especially for a signal event: the disappearance of 75% or more of a person’s assets during the previous two years. “The reason we look at 75% or more is that we’re looking for a sudden loss, one that’s high enough to be shocking. People are nearing retirement, and all of a sudden their wealth is gone,” said Dr. Pool.

Over the 20-year period, one in four participants endured a wealth shock—losing 75% or more of their savings. They were twice as likely to have died during the study compared to those whose savings remained intact, explains Pinker. Men were more likely to have died as a result. But women were more likely to have experienced a wealth shock. Their survival rate, however, was much higher.

The study can’t explain why losing your life savings can kill you, only that it does. But one of the researchers’ findings is clear: At 50%, the mortality risk of those who had lost their nest eggs was lower than for those who never accumulated much for retirement at all; those people were 67% more likely to die than savers. It may be cold comfort, but it seems that it’s better to have saved and lost than never to have saved at all.

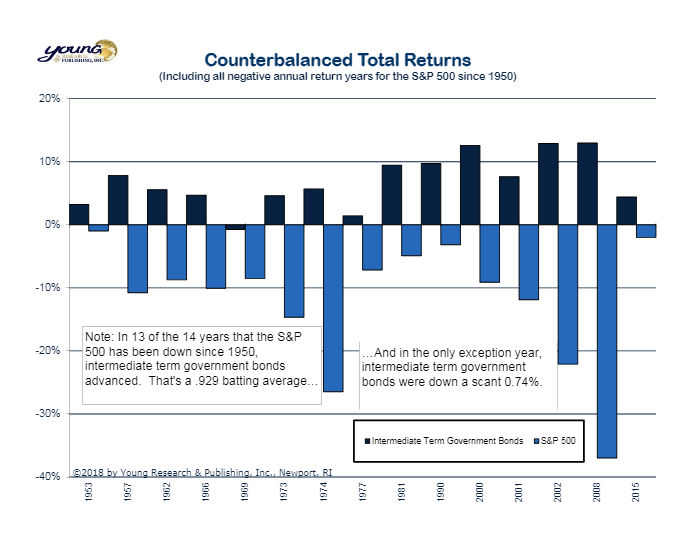

My takeaway? Avoid the big time losses at all costs. It’s OK to lose money, temporarily. If you don’t sell, you don’t lose. In fact you accumulate more shares at lower prices. And having all of your money tied to the stock market is no way to invest in, or during, retirement. You want to deploy a counterbalanced approach that will allow you to have the guts to stay invested when times are tough.

Originally posted on Yoursurvivalguy.com.