Last week the market was surprised by an unintentionally early release from Google, which reported earnings much lower than analysts had expected. But Google wasn’t alone in missing earnings estimates. Chipotle Mexican Grill, General Electric, Ingersoll-Rand, Baker Hughes, Honeywell and others also came in below estimates, disappointing shareholders. But should analysts and investors be surprised?

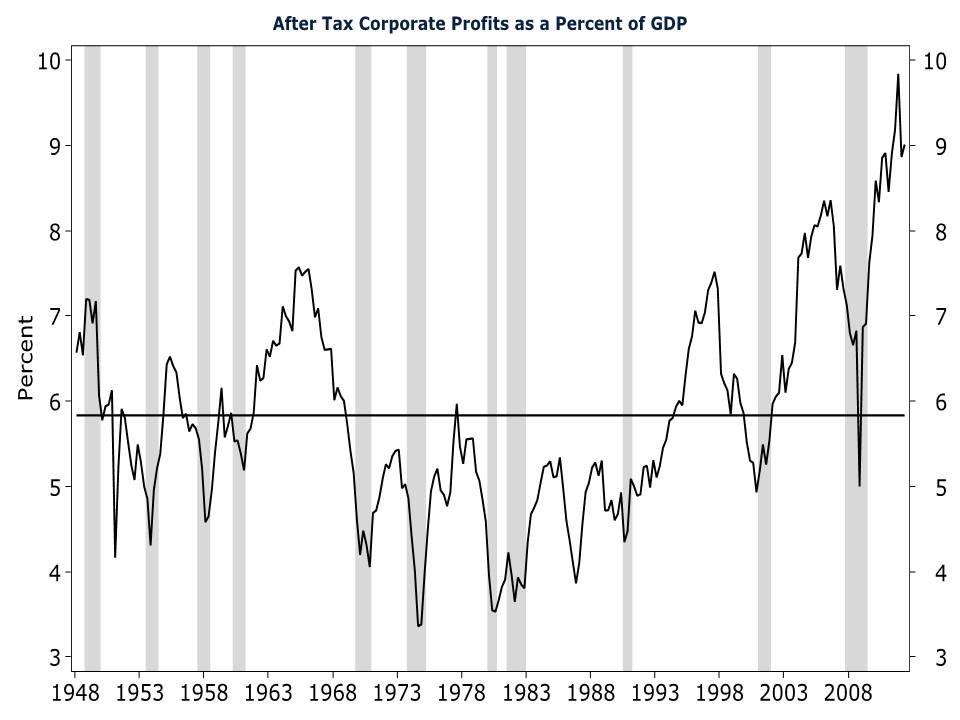

As you can see in the chart below, margins (estimated using corporate profits as a percent of GDP) maxed out in the fourth quarter of last year. Companies did all they could to boost margins during the recession. They trimmed the fat on their expenses and fired all unnecessary employees. But there’s nothing left to cut.

So what is driving expectations higher than reality? Without GDP growth or increased productivity from employees, companies will have a hard time increasing margins. But the stock market, until last week, seemed not to believe this fundamental logic. The reckless monetary and fiscal policies being pursued by the Federal Reserve and state, local and federal governments have distorted the market’s appreciation of the dismal economic state today.

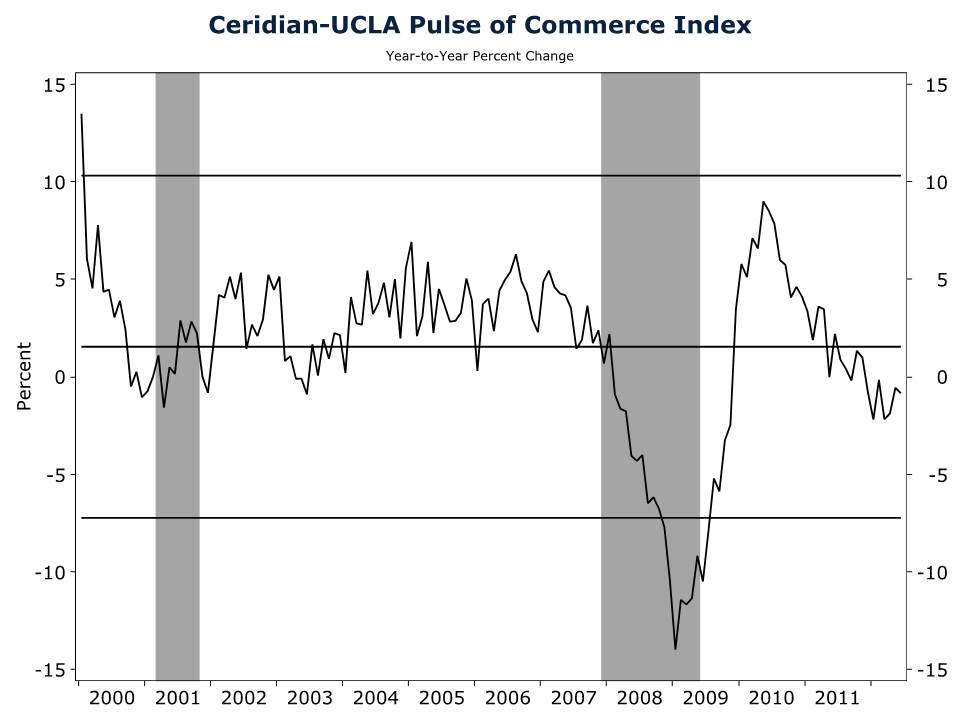

Broad estimates of economic momentum shouldn’t give investors much optimism. For seven months the Ceridian Pulse of Commerce Index has been declining on a year over year basis. The index has only performed that poorly during the Great Recession.

Without strong economic growth, and without costs to cut, companies are looking at a number of hard quarters of margin contraction. Expect to see CFOs telegraphing much more conservative estimates for the next year as they attempt to realign expectations with possible realities. As the first chart shows, margins have averaged around 5.8% since the 1940s. Mean reversion suggests current margins of around 9% cannot be sustained for long.