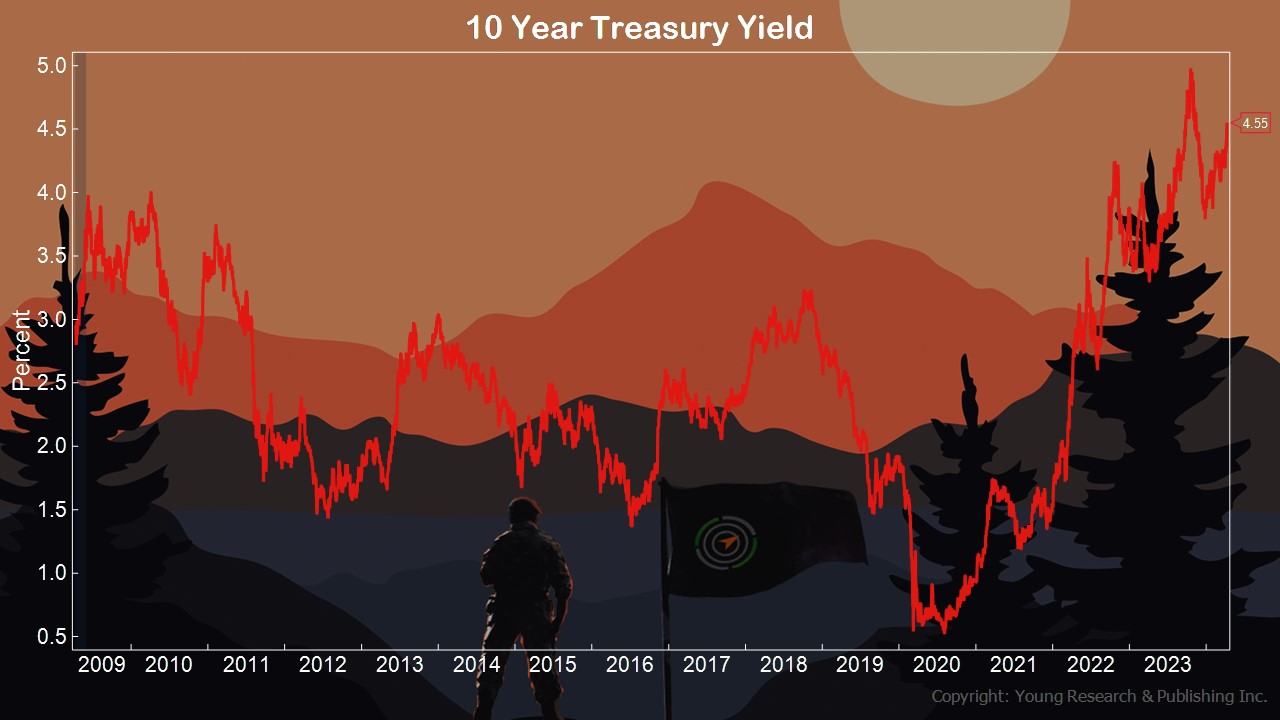

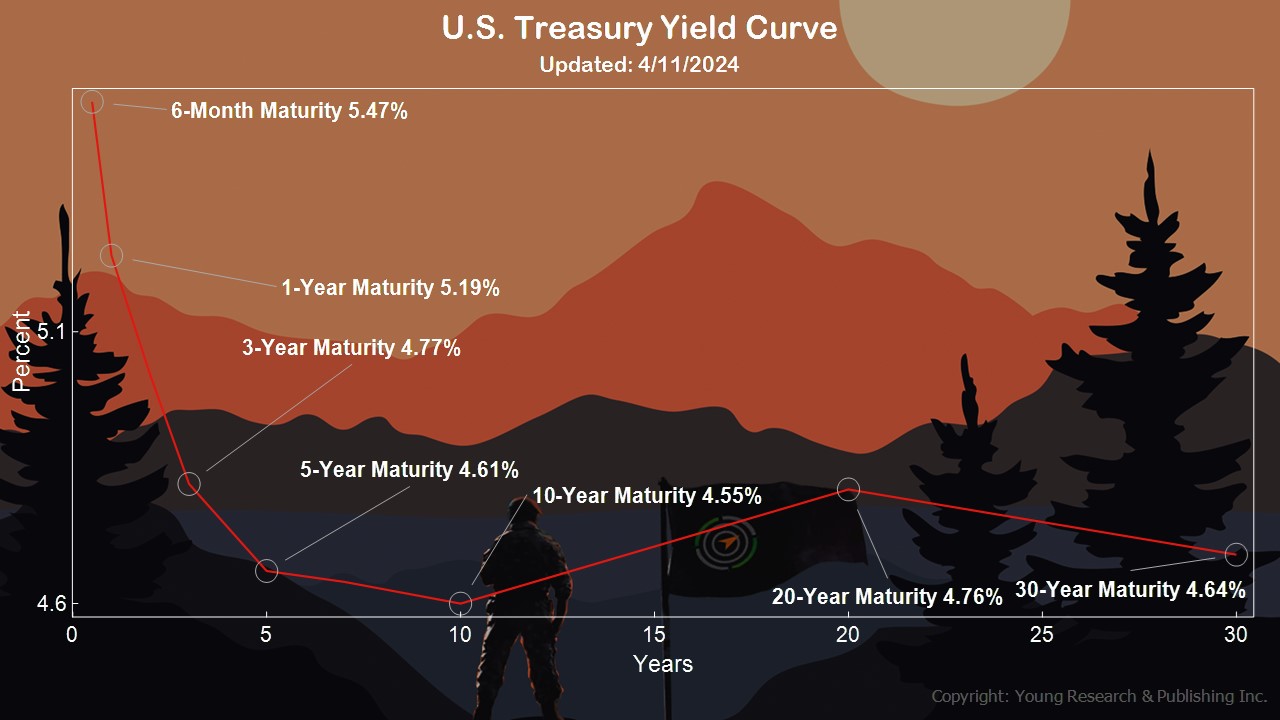

With the 10-year treasury at 4.5%, retired and soon-to-be-retired investors are seeing rates they can sink their teeth into for longer—don’t let inertia keep you down.

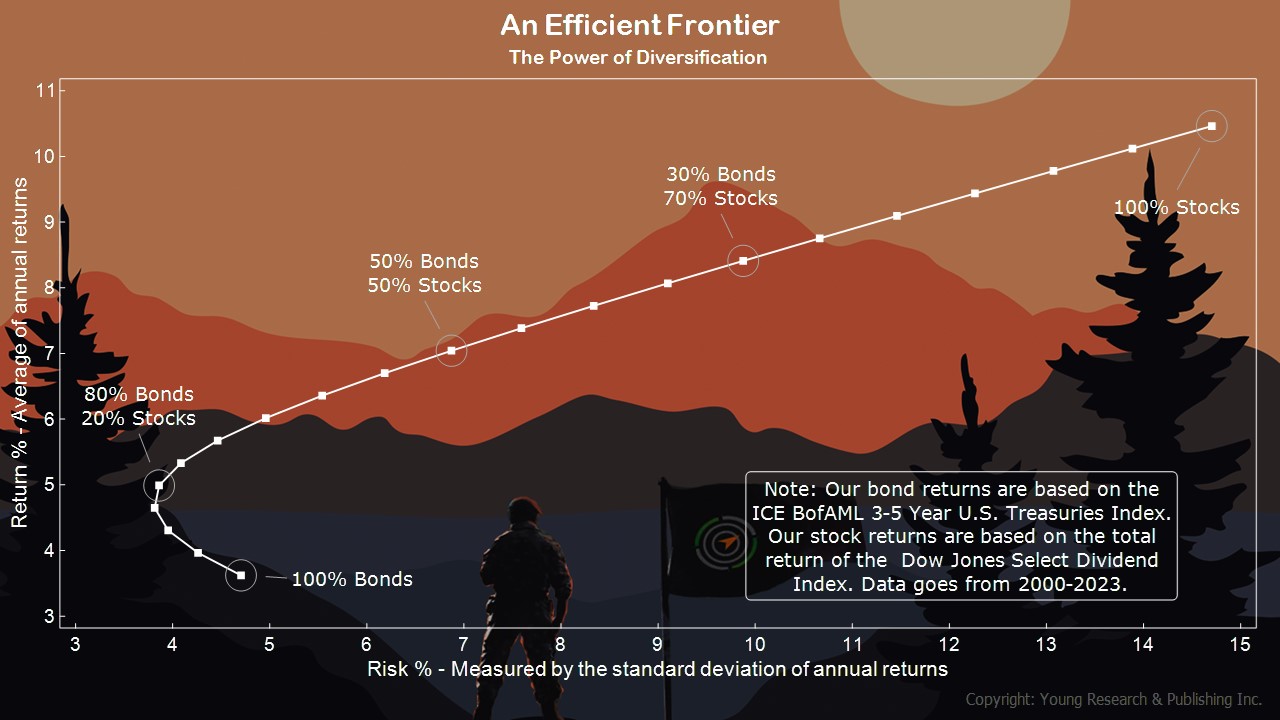

How high will they go? Not my concern. What I am concerned about is that you get paid during your golden years with some cold, hard cash from interest payments. Consider a mix of stocks and bonds. Run your finger along my efficient frontier and understand it’s not necessarily what you invest in but how you invest. In other words, are you diversified?

How about your CDs that are maturing? Pay attention because rolling them over may not provide the yield you think you’re getting. In my conversations with you, you’re telling me exactly that. What I suggest you do is consider shopping around or consider money markets. Get your lazy cash off the sidelines and into the game.

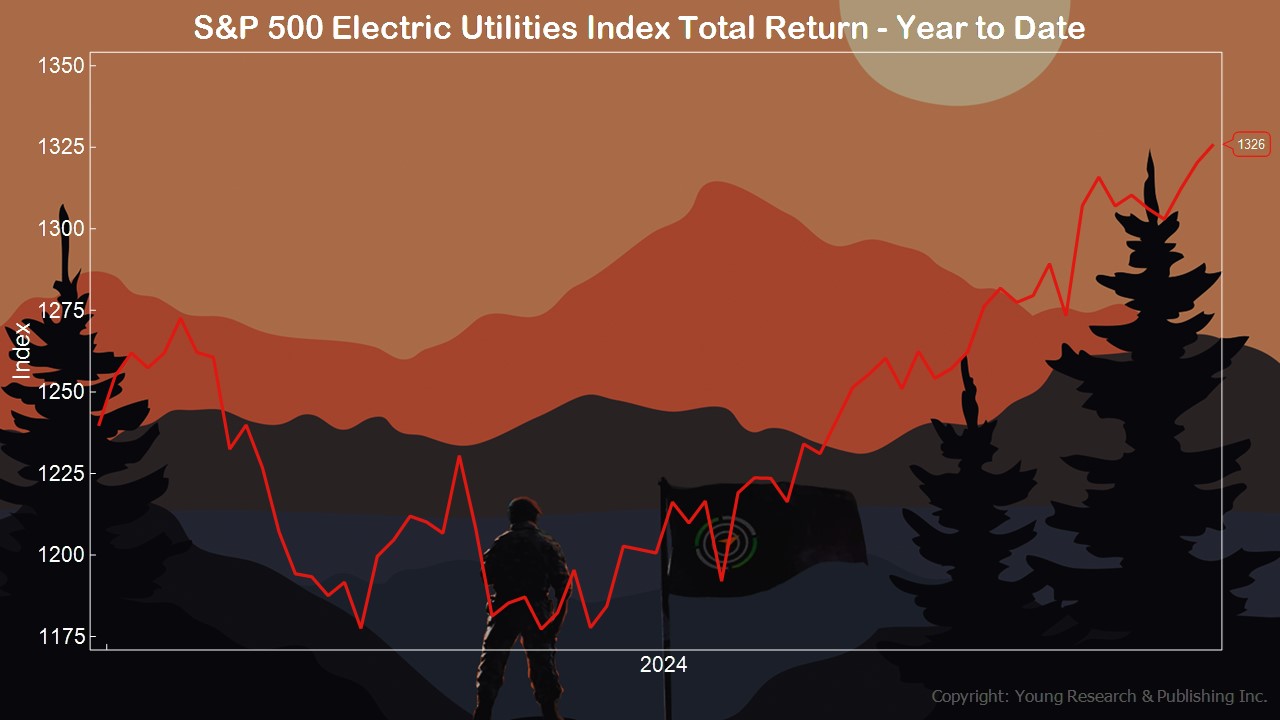

If you have a pile of cash, your first course of action is to determine risk tolerance. As you know, investors tend to realize they have risk intolerance, like a food allergy, after the fact. If you want to take advantage of AI, consider the massive energy use required and consider an approach where you get paid to invest in the form of dividends.

Action Line: When you’re ready to talk, I’m here.

Originally posted on Your Survival Guy.