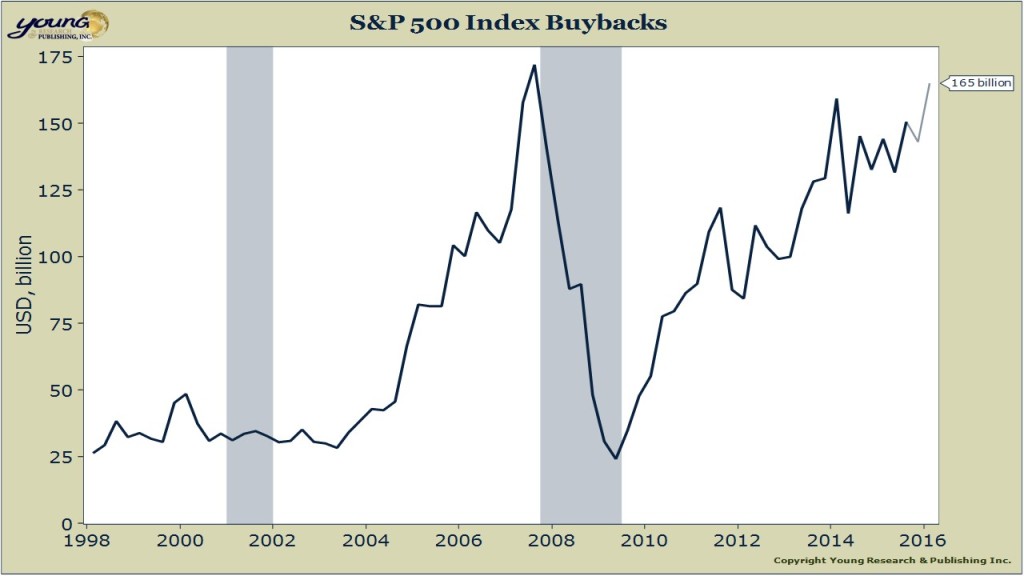

Buybacks Near All-Time Highs

Forecasts for Q1 2015 show S&P 500 companies nearing all-time high stock buybacks.

Almost Half of Cash Spent on Buybacks

American companies have been spending lots of cash on buybacks. IB Times‘ Owen Davis reported in November:

Of the $2.2 trillion in cash corporate America is poised to spend next year, roughly half will go directly to shareholders. Between stock buybacks and dividend increases, Goldman Sachs estimates that just over $1 trillion will end up flowing to shareholders, a 7 percent increase over 2015.

“Despite weak activity during the first half of 2015, buyback activity will remain robust,” wrote Goldman’s chief U.S. equity strategist David Kostin in a note to clients Monday.

The projections show that although increasing in absolute terms, spending in the Standard and Poor’s 500 on research, development and capital expenditures will fall as a percent of overall budgets. Kostin sees R&D increasing 5 percent over 2015 to $256 billion, while capital expenditures — spending on infrastructure upgrades and new facilities — increase just 1 percent, held back by a sagging energy market.

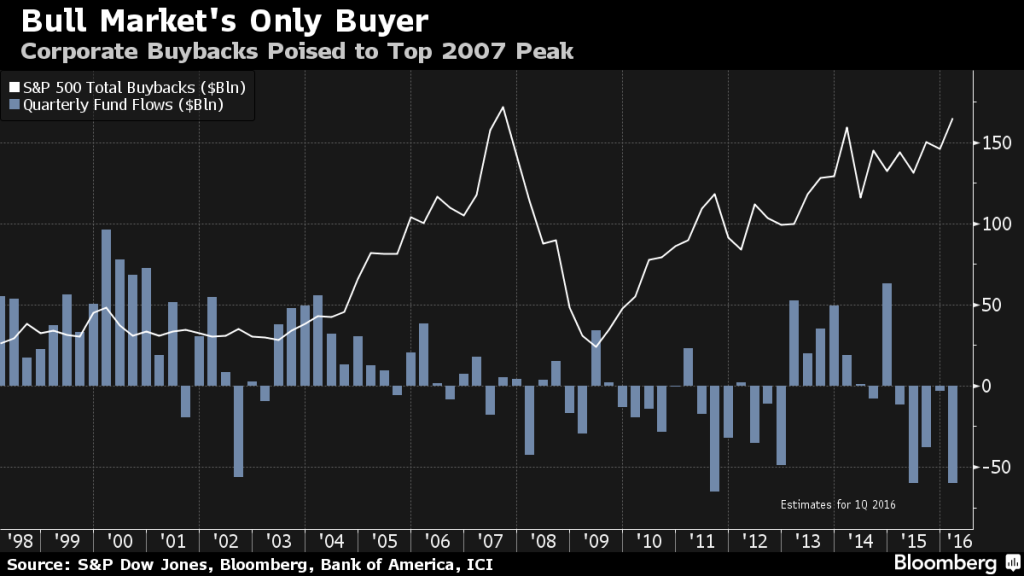

Are Buybacks Driving the Market?

But are buybacks the only thing keeping markets off life support? Lu Wang from Bloomberg writes:

Demand for U.S. shares among companies and individuals is diverging at a rate that may be without precedent, another sign of how crucial buybacks are in propping up the bull market as it enters its eighth year.

Standard & Poor’s 500 Index constituents are poised to repurchase as much as $165 billion of stock this quarter, approaching a record reached in 2007. The buying contrasts with rampant selling by clients of mutual and exchange-traded funds, who after pulling $40 billion since January are on pace for one of the biggest quarterly withdrawals ever.

VIDEO: Can Buybacks Continue to Prop up Markets?