Back in 2008, well before U.S. markets began spiraling out of control, Russian stocks tumbled in free fall. This was not an earlier realization of the financial crisis, it was a reaction to Russia’s invasion of its southern neighbor Georgia. You may not remember that invasion because the Olympics were on at the time and of course, it was summer.

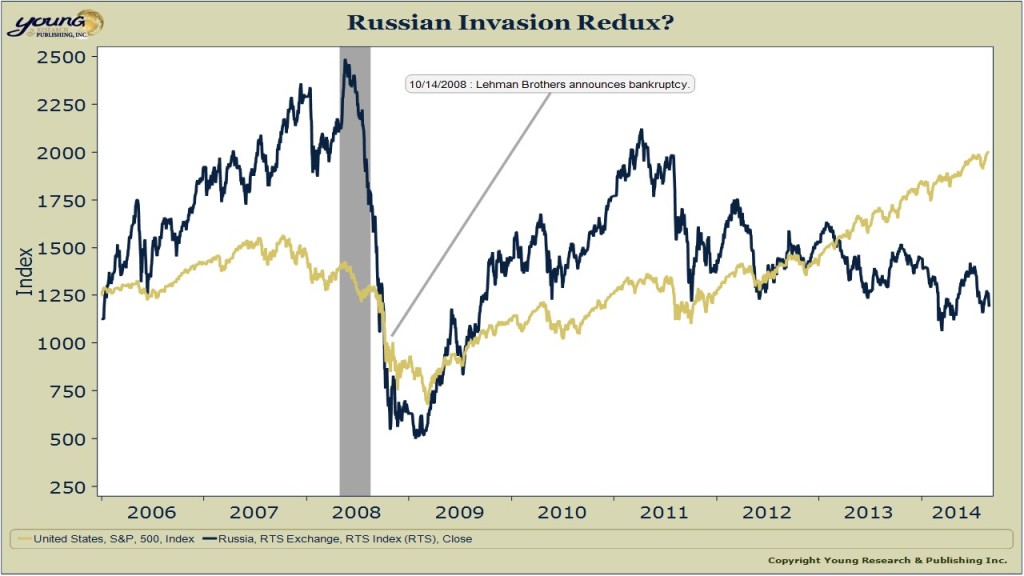

But from the time the Russians moved into Georgian territory to the time the final signature was placed on the peace treaty (this time span shaded in grey on the chart below), the RTS fell 16%. Meanwhile, U.S. markets dropped 6.7%. Mind you this all happened before Lehman Brothers collapsed and the real panic set in.

Compare that to today. It is being widely reported that the Russian military has invaded Ukraine to fight alongside rebels there, and the market has essentially given this news a pass. Sure Russian stocks haven’t been performing well since 2011, but one of the world’s nuclear powers just invaded one of its most important neighbors and investors haven’t really blinked an eye.

Perhaps the Federal Reserve fueled liquidity bubble floating the S&P ever higher is having residual effects on foreign markets including Russia. And perhaps the oil companies that make up the majority of Russia’s market cap are still attractive given the high price of oil. But even in the face of those upward price pressures it’s confounding that the Russian market hasn’t reacted to a greater extent given the comparison to the 2008 conflict pitting Russia against a less significant country. The invasion of Ukraine could have major effects on Europe’s economy. If natural gas and oil supplies, much of which run through Ukraine from Russia to Europe, are cut, manufacturing, agriculture and home heating could be devastated on the continent. Risk is piling on in Europe and the markets don’t appear to be noticing.