About two months in, how is my Short-term bull-bear model performing?

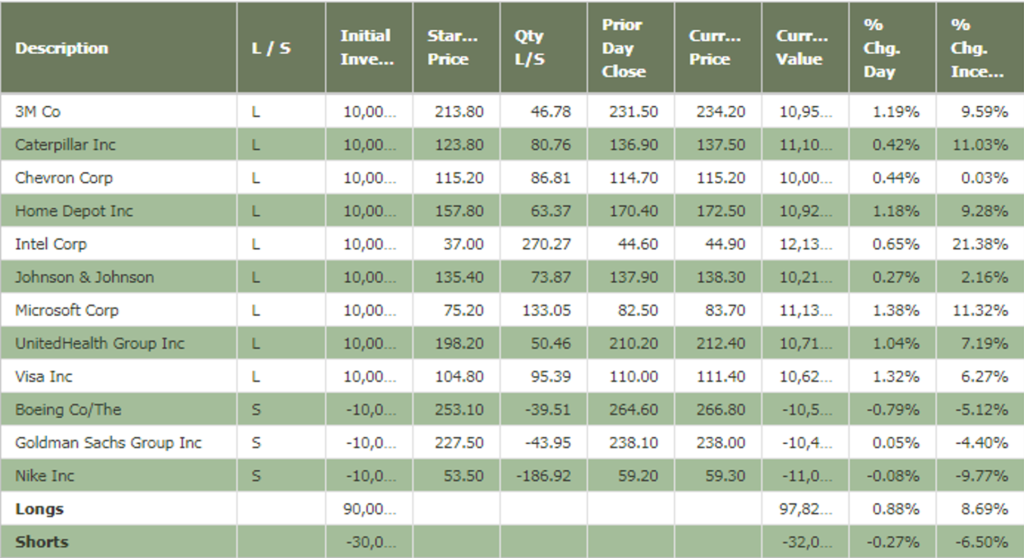

I couldn’t be happier. The bull-bear model has made almost 8.8% on the longs and lost only 6.4% on the shorts.

If you started with $90,000 in capital and invested $10,000 in each of the long positions and sold short $10,000 of the three short positions, you are sitting on a gain of 6.4% in only two months. The Dow is up 5.6% over the same time-period.

So six of one, half dozen of the other, right?

Not exactly, a 6.4% return in the bull-bear portfolio was achieved with only two-thirds of the stock market exposure of a long-only portfolio. You are making more by taking less stock market risk. If the long portfolio and the short portfolio would have matched the performance of the Dow, the bull-bear model would have been up 3.83% or two-thirds of the Dow’s 5.6% return. See the correlation? Two-thirds market exposure would have resulted in about two-thirds of the return.

But the bull-bear model is doing much better than that. What’s driving the performance? Caterpillar, Microsoft, and Intel are all big winners. All three are up double digits on the back of stronger than expected earnings. Intel is the standout with a return of more than 21%.

Model Guidance: No Changes for the Week

My short-term Bull & Bear Portfolio consists of 9 equally-weighted long positions and 3 equally-weighted short positions. Both the long and short stocks are selected from the Dow Jones Industrial Average. If the Dow advances over the period in which my 12-Dow stock portfolio is open, the model will make money with the stocks that advance and will lose money with the stocks that decline. And the opposite will prevail for the short stocks. Each week, I will review the model portfolio for potential changes. If no changes are required, I’ll simply post no changes for the week. You can read more about my Bull & Bear Portfolio here.

Click on table to view in full on Youngsworldmoneyforecast.com

Featured Company: Intel Corporation (NASDAQ:INTC)

In 1968, the year 2001: A Space Odyssey was released, mankind was looking to the stars and the future of technology. The Apollo space program was heating up in preparation for the moon landing the year after. Computers were being made smaller and more powerful in order to the meet the demands of the space program and other advanced technological undertakings.

That same year, two men named Bob Noyce and Gordon Moore founded Intel. The company’s first product would be produced in 1969. It was the 3101 Schottky bipolar random access memory (RAM). The team would also break ground by introducing the world’s first metal oxide semiconductor static RAM, the 1101. By 1970 Intel had upended the entire industry by introducing the 1103 DRAM, a new standard in computer memory technology.

Intel’s hits would keep on coming. In 1974 the company introduced the first general-purpose microprocessor. In 1975 Intel processors were shipped on one of the first PCs, the Altair 8800. In 1981, computing giant IBM would select Intel’s processors for its line of PCs. In 1992 Intel became the world’s largest semiconductor supplier. Through the 1990s Intel would introduce and continuously improve its Pentium line of processors. In 2006 Intel introduced the world to the first quad-core processor for desktop computers.

Today Intel is transforming its business from a focus on PCs to a focus on the cloud and smart devices. Intel is pushing forward cloud technology with its innovations like the Intel Optane. The product is the first to combine memory and storage, making the cloud faster and more efficient.

Originally posted on Youngsworldmoneyforecast.com.