Has the long anticipated recovery in housing finally arrived? The latest round of economic data on the housing market points toward improvement. On Wednesday, the National Association of Home Builders (NAHB) released their monthly home builder confidence index. The NAHB/Wells Fargo Housing Market Index asks builders to rate current single-family home sales and sales expectations and prospective buyer traffic. The responses are used to generate an index where any number over 50 signals that more builders view conditions as good than bad. In January, the Housing Market Index increased to 25—the fourth consecutive increase and the highest reading since June of 2007. Confidence improved in every region of the country—with the biggest improvement coming from builders in the Northeast.

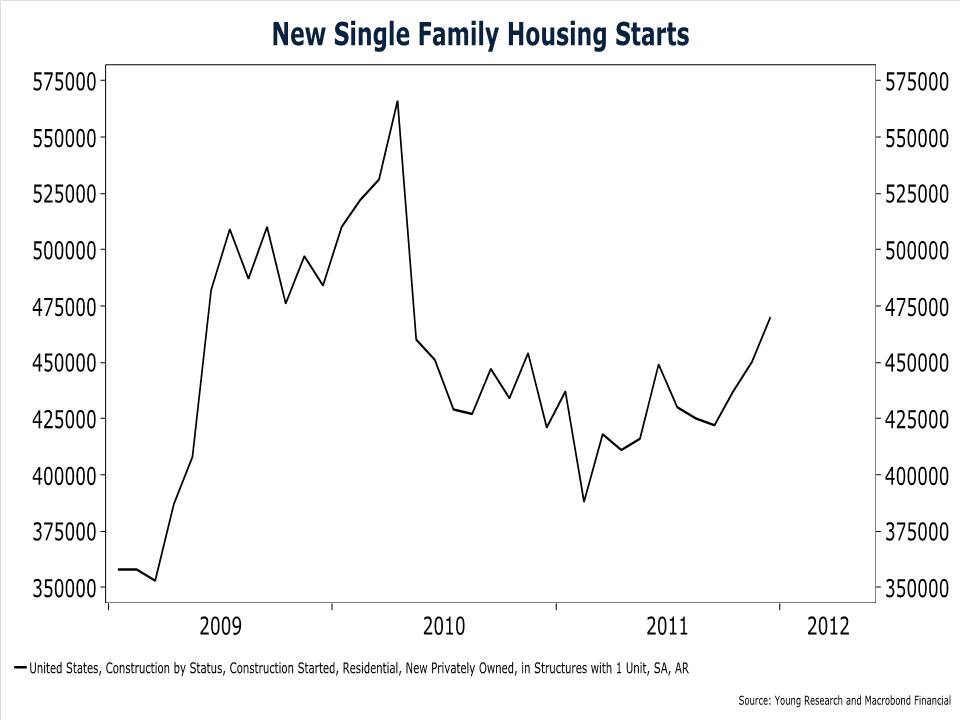

New single family housing starts which have been in the basement for over three years are also showing signs of improvement. In December, single-family housing starts rose 4.4% to their highest level since April of 2010. Building permits, a leading indicator of housing construction, have also been trending up in recent months.

Some investors are now forecasting that the long awaited real estate recovery has finally arrived. The SPDR Home Builders ETF is up 17% in January alone and almost 50% from its October low. There is no denying the improvement in housing data over recent months, but the exuberance of investors may be overdone. This is at least the third time in as many years that investors have bid up home builder shares in anticipation of recovery. While housing activity (construction, permits, and starts) has improved, the housing market still faces major cyclical and structural headwinds. Chief among them is the housing market’s shadow inventory. There are millions of homes in the foreclosure pipeline or being held off the market that are likely to depress home prices and hinder a more robust housing market recovery. Tighter lending standards have also reduced the pool of potential buyers. The bottom line: we remain cautious yet hopeful that a housing recovery is underway.