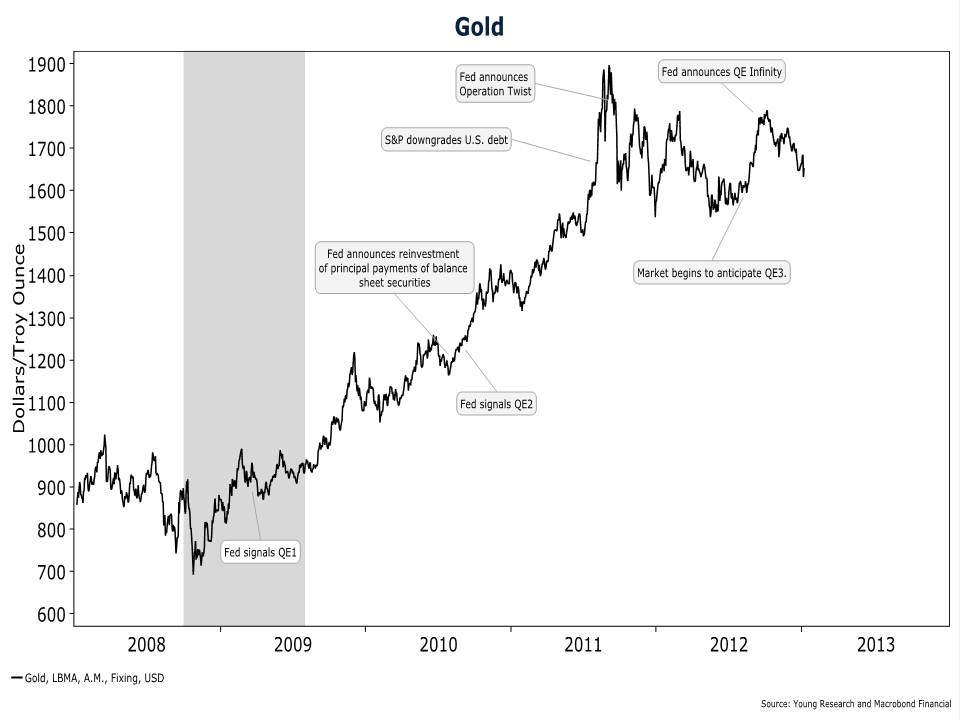

In the last five years the price of an ounce of gold has increased 93%. Easy monetary policies and the downgrade of many sovereign debt ratings, including that of the U.S., have contributed to the high demand for the safe-haven precious metal.

Since May 16, in the lead up to September’s Federal Reserve announcement of QE infinity, the market pushed the price of gold up by 12.6%. The price of the yellow metal has been consolidating but could break out at any moment. Gold should be a component of all investment portfolios today as a hedge against profligate fiscal and monetary policy because it’s gold today and will remain gold tomorrow. The value of the dollar on the other hand is less predictable.