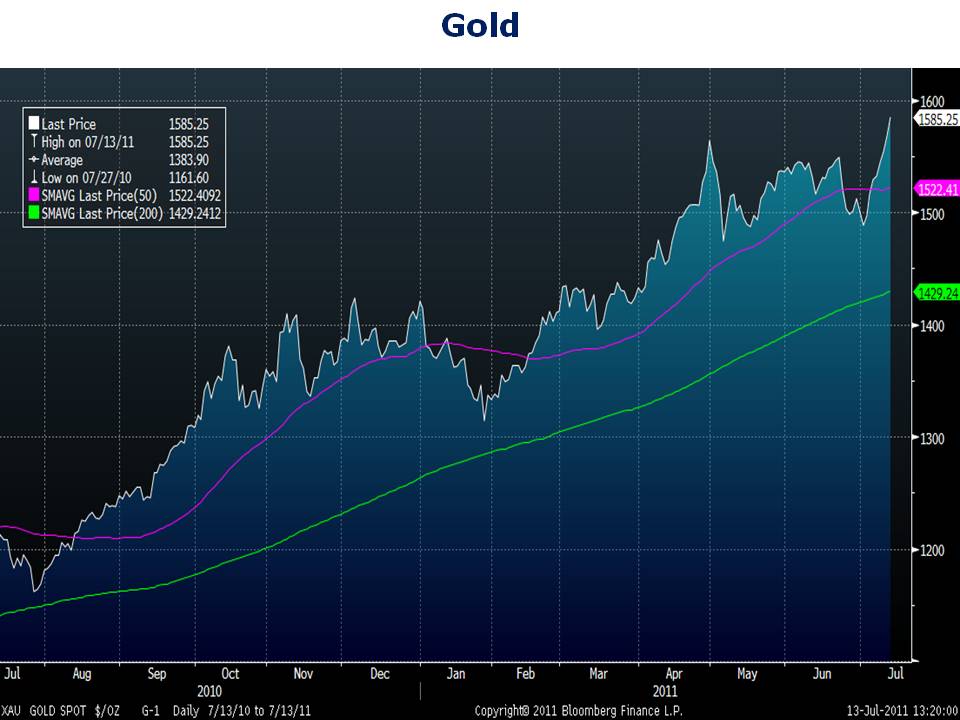

Gold is up more than 6.5% since the first of the month. The precious metal is rallying on fears that the euro-area financial crisis may infect Italy and an indication from Chairman Bernanke that the Federal Reserve hasn’t ruled out another round of money printing. I’m not sure who believed that the Fed took QE3 off the table, but based on the price action in financial markets today, apparently some investors did. Gold is up $18 today, silver is up more than 5%, wheat is up 6.4%, oil is rallying, the Dow is up over 100 points, and the dollar has fallen to a new low versus the Swiss franc.

You Might Also Like:

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023