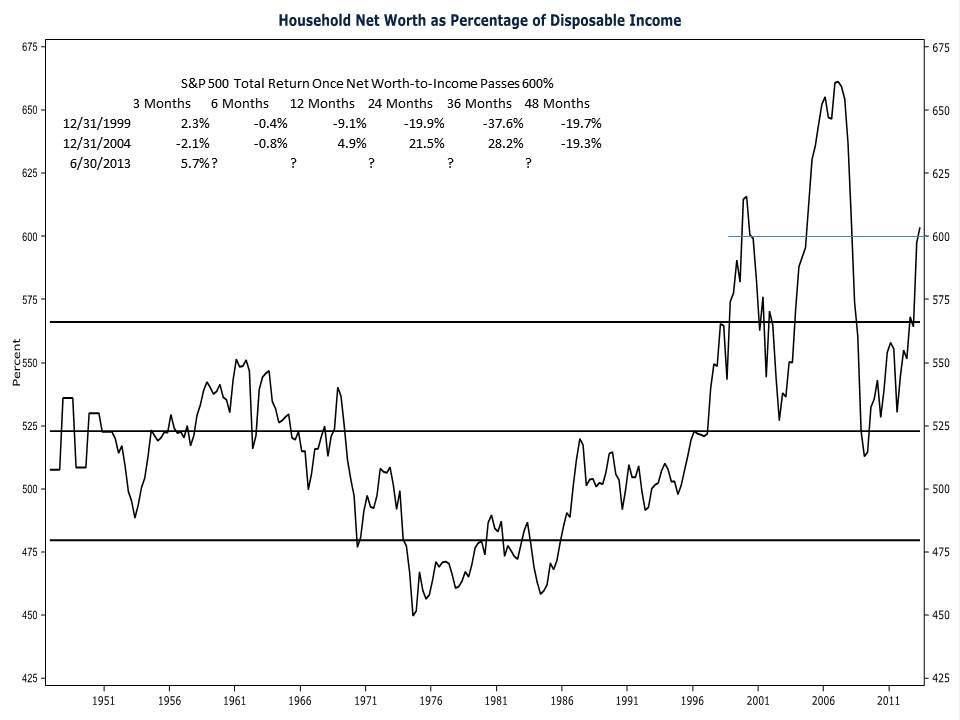

The Federal Reserve released its quarterly flow of funds data yesterday. One of the key items in the Fed’s quarterly report is the net worth of households. The good news from the report is that household net worth increased in the second quarter. The bad news is that growth in household net worth once again outpaced growth in disposable income. Since the value of an asset is determined by the income that asset can be expected to generate, there should be some relationship between household net worth (assets minus liabilities) and income. That is to say that asset prices should be bounded by income. And as our chart shows, net worth has indeed been bounded by income for over six decades. Unfortunately, due to ultra-loose monetary policy, the net worth of households in relation to income has been pushed back to bubble-era levels. As the table on our chart shows, that isn’t necessarily an indication of impending doom, but it should be treated as a sign of caution.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023