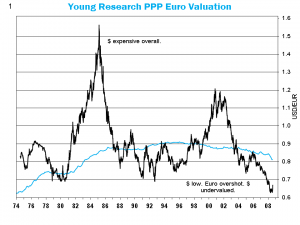

The pillars of support preventing the overvalued euro from depreciating versus the U.S. dollar are quickly crumbling. On a purchasing power parity basis, our favored approach to estimating long-term currency values, the euro is deeply overvalued and has been for some time (Chart 1).

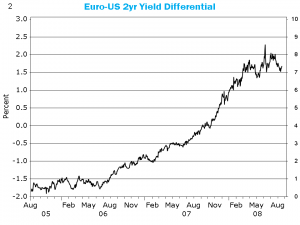

The euro has been supported by a positive and rising interest rate differential between euro interest rates and U.S. interest rates. Chart 2 shows the interest rate differential between 2-year government bonds in the Euro-Zone and the U.S.

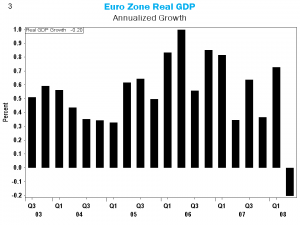

The widening interest rate differential was caused by successive interest rate cuts in the U.S. without a corresponding response from the European Central Bank (ECB). The ECB has been more concerned with quelling inflation than spurring growth, but that is now beginning to change. The Euro-Zone economy may already be in recession. Chart 3 shows that GDP contracted by .2% in the second quarter.

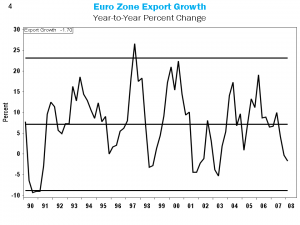

The combination of an overvalued euro and a weakening global economy is part of the problem. Chart 4 shows that Euro-Zone export growth is now tailing off at a rapid clip.

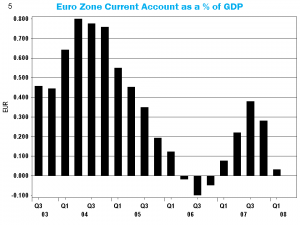

Declining exports are resulting in a deteriorating current account position (Chart5). If the current account in the Euro-Zone moves into deficit, look for further weakness in the euro.

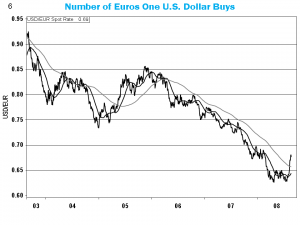

The euro is overvalued, the interest rate differential with the U.S. is narrowing, economic growth is weakening, the current account position is deteriorating, and even the technicals are weak. Chart 6 shows that the euro recently broke through its 200-day moving average, a key support level.

The trend of appreciation is now broken. You can be sure all of the trend-following currency traders are now bailing out of the euro. Do not be surprised if, over the next few years, the euro depreciates by another 20-30% from here. If you have significant exposure to the euro you may want to reconsider your position. There are better foreign currencies to invest in than the euro. Subscribers to Richard C. Young’s Intelligence Report have been warned for months to avoid exposure to the euro and instead to focus on a portfolio of undervalued structurally sound currencies.

Jeremy Jones, CFA, is the Director of Research at Young Research & Publishing and the Chief Investment Officer at Richard C. Young & Co., Ltd., Investment Advisors.