Chuck Schumer, the liberal democratic senator from New York is out with some post-election blather on the fiscal cliff. Schumer and his liberal allies have yet to figure out that higher tax rates don’t generate more revenue. Here is what he said during an address at the Christian Science Monitor Breakfast yesterday.

From the Daily Caller:

“It’s a lovely thing but it’s a fairy tale…it is the Rumpelstiltskin tax fairy tale that if you cut taxes you increase revenues.”

Mr. Schumer’s beliefs are grounded in a fantasy land where higher rates don’t encourage tax avoidance. But the truth is, they do. This is most evident with capital gains taxes. Mr. Schumer, along with many in his party, wants to tax capital gains at the ordinary income tax rate.

Taxing capital gains at ordinary income rates is a terrible idea. Not only because the capital gains tax is a double tax on corporate income. Or that the U.S. already has the fourth highest combined corporate and capital gains tax rate in the world. Or that capital gains are not indexed for inflation which turns a seemingly low rate into a high rate. And not even because a higher capital gains tax rate discourages investment, the very lifeblood of economic growth.

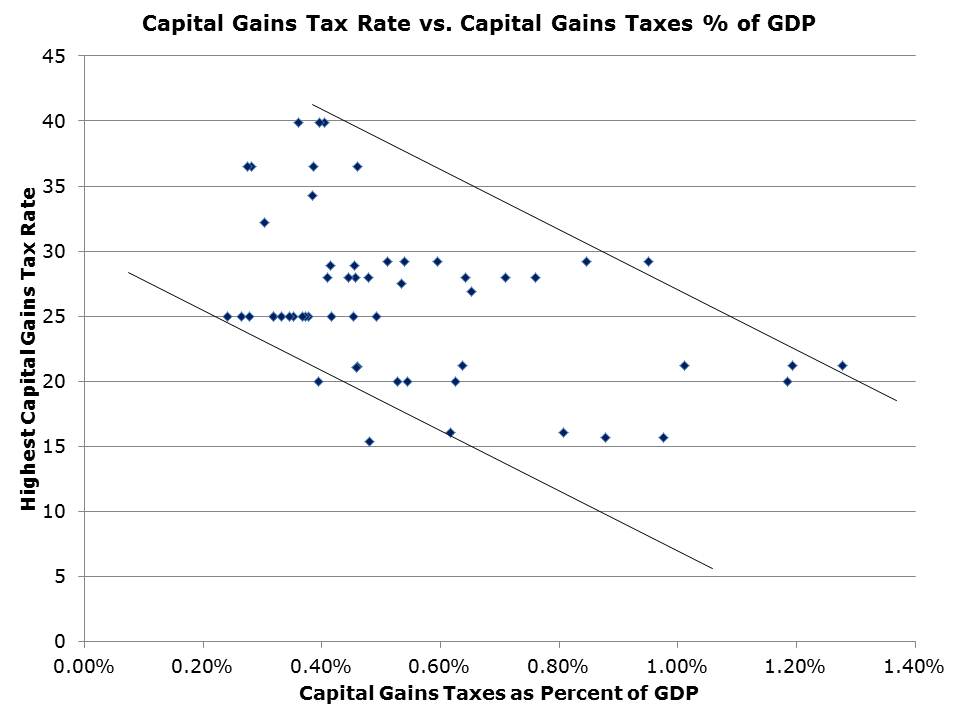

Nope, even ignoring all of these reasons, taxing capital gains as ordinary income is a terrible idea because it will generate less tax revenue. Look at the historical record. Below is a scatter plot chart of the highest capital gains tax rate versus the amount of capital gains tax revenue collected as a percentage of GDP. The capital gains tax rate is on the vertical axis and the horizontal axis shows capital gains taxes collected as a percent of GDP. Notice the inverse relationship between tax rates and taxes collected? The higher the capital gains tax rate, the lower the amount of capital gains tax revenue paid to the government.

The only folk telling fairy tales about taxes in Washington are Mr. Schumer and his friends in the Senate.