You read last week about putting margin of safety to work in your portfolio. I told you about three strategies we use to pick stocks with the margin of safety in mind. The first and most important is that the only stocks we buy pay dividends. Below you’ll read an excerpt explaining the benefits of dividend investing from our free special report, Collecting Rare and Hard to Find Dividends. I’ll detail the other strategies in the weeks ahead.

Reduce Risk with Dividend Stocks

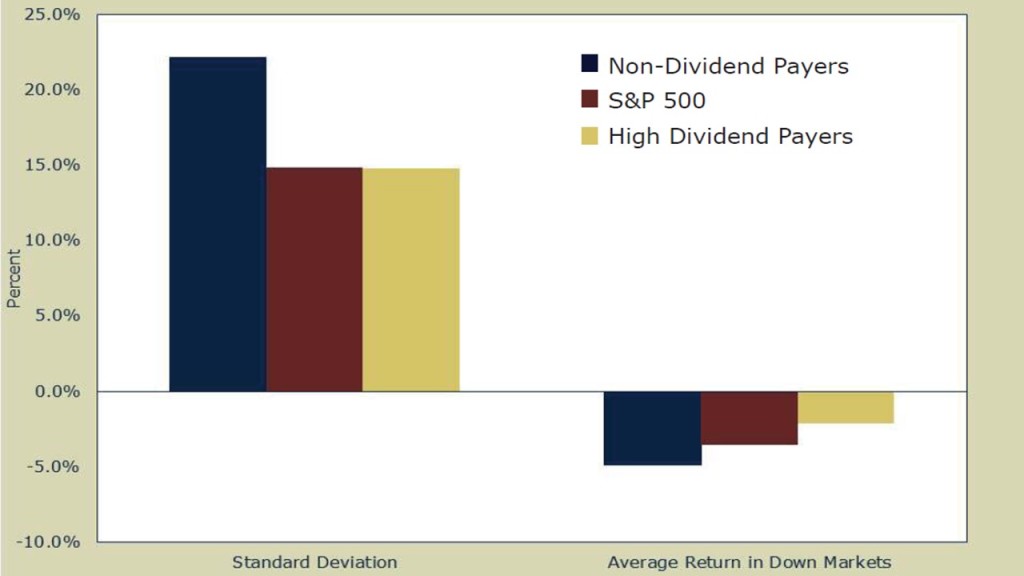

What’s more, dividends help reduce portfolio volatility. Figure 3 shows that high-yielding stocks have been less volatile than non-dividend-paying stocks. And high-yielders have held up better in down markets than both non-dividend-payers and broad-based stock-market indices such as the S&P 500.

Dividends: A Shortcut to Quality

A dividend strategy can also help you avoid many of the pitfalls that wreak havoc on even the most seasoned investors’ portfolios. Dividend-paying companies are often more durable businesses than non-dividend-payers. Payers are also more likely to operate in industries with higher barriers to entry and have stronger balance sheets than non-dividend-payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends is a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams rarely commit to higher dividend payments unless they are confident the dividends can be maintained through thick and thin.

Cold, hard cash in the form of quarterly dividend payments can also help investors avoid some of the most deplorable examples of corporate fraud. Who can forget the accounting frauds of Enron, WorldCom, and Tyco that decimated many retirement portfolios? Not a single company in the group paid a meaningful dividend. Companies can manipulate and fake earnings by using creative accounting techniques, but regular dividend payments can’t be faked.