It seems Mr. Bernanke’s bludgeoning of individual investors is finally starting to pay dividends. Four years of pinning short-term interest rates at zero with a promise to hold them at zero for another two years and a commitment to buy massive quantities of long-term Treasuries and mortgage backed securities ad infinitum has put stocks back in favor with individual investors, for all of the wrong reasons of course. Nonetheless individuals are buying stocks at the fastest pace in years.

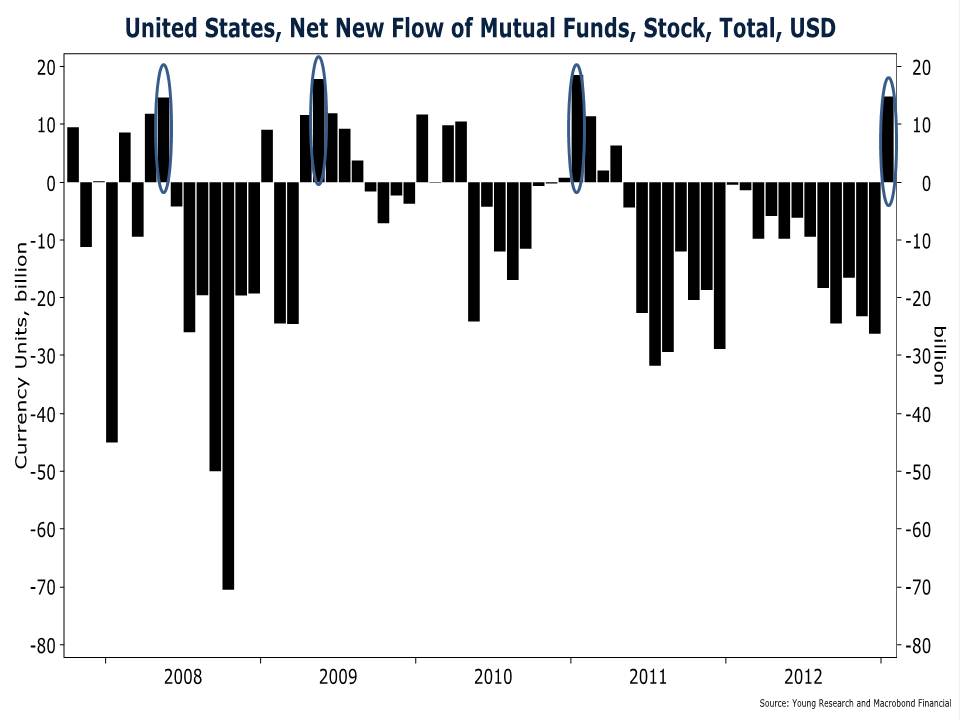

The Investment Company Institute reported net equity mutual fund inflows of almost $15 billion for the week ending January 9th. Our chart on monthly net inflows to equity mutual funds put the $15 billion weekly inflow into perspective. Since the end of the previous bull market in October of 2007, there have only been three months when equity funds have seen inflows as high as they were in the first week of 2013.

The majority of the money that investors are putting to work in the stock market is going into U.S. stocks. But the more compelling opportunities may be abroad. Did you know that the 16% return of the S&P 500 last year trailed many of the world’s major stock markets? In 2012 German stocks were up 32%, French stocks 22%, Swedish Stocks 23%, Swiss stocks 21%, and Australian stocks 24%. Some of the world’s emerging markets put up even more impressive numbers. Colombia was up 30% last year, the Philippines was up 46%, Poland 44%, Thailand 45%, and Turkey an eye-watering 66%.

If your common stock portfolio is still lacking an international component, I am afraid you are missing the boat.