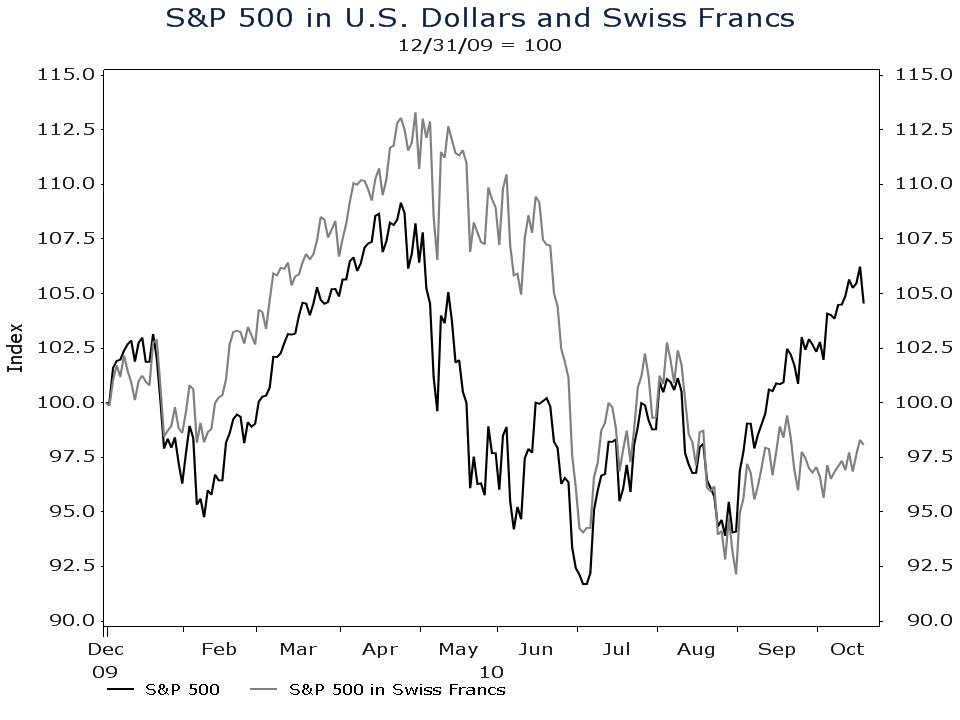

The S&P 500 has been on a tear since the Fed first started floating the idea of quantitative easing 2.0. Since August 31, the S&P is up more than 11%. The gains are of course nice to see, but the rally is a phony. Stock prices are not rising on improving fundamentals or cheap valuations. Stocks are rising simply because investors are anticipating that the Fed will print more money. For proof that the rally is a phony take a look at the performance of the S&P 500 in terms of a hard currency such as the Swiss Franc. My chart shows that in Swiss franc terms, the S&P 500 still hasn’t breached its early August high. The Fed is debasing the value of the USD and creating illusory stock market gains.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023