Is it just me or has the quarterly earnings season become nauseating? At Young Research we try to spend as little time as possible scrutinizing the short-term results of the companies we follow for Intelligence Report and Global Investment Strategy. But the quarterly earnings headlines are unavoidable in the Wall Street Journal and other financial publications.

The chief focus of the media seems to be on quarterly earnings surprises—whether or not a company beat the consensus earnings per share estimate. Companies that beat estimates often see their shares rise and those that miss see their shares drop. Never mind that one quarter’s worth of earnings has almost no impact on the value of a stock. The value of a stock is exactly equal to the sum of all future cash flows discounted at an appropriate rate. Notice I didn’t say last quarter’s earnings.

But a long-term focus has never been the purview of Wall Street, so one can understand the Street’s focus on quarterly earnings minutiae. Nonetheless, the whole process of quarterly reporting has become a carefully choreographed con job.

Companies provide “earnings guidance” to the analysts following their stock. Knowing that when companies beat estimates they are treated much better than when they miss, management often provides low-ball guidance. And instead of coming up with their own independent estimates, most analysts just republish the guidance provided by company management—setting the stage for an earnings surprise.

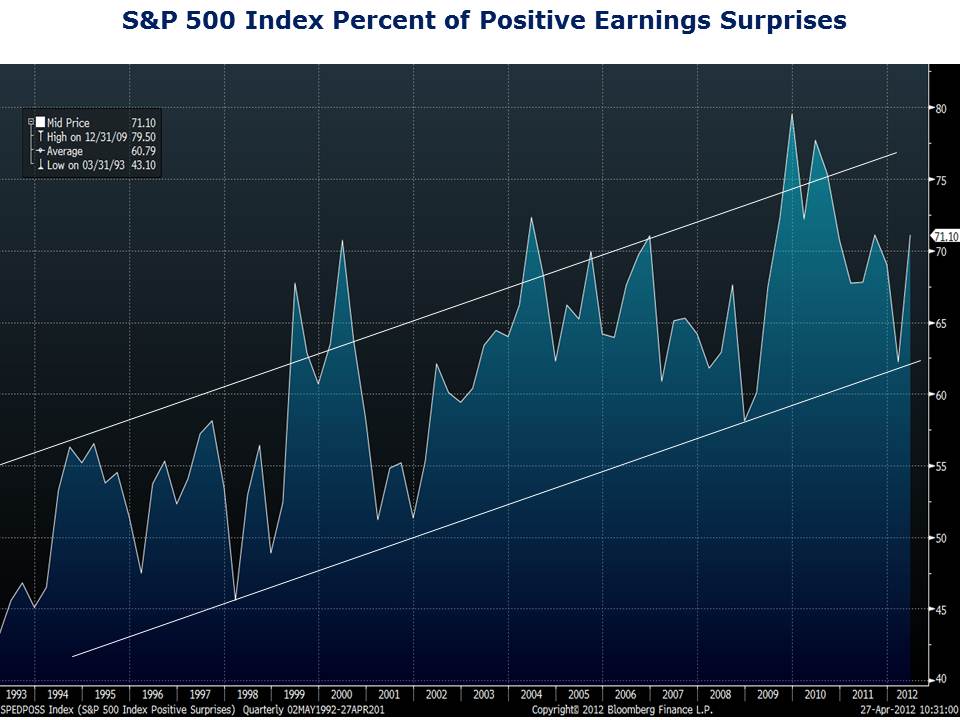

When earnings reporting season rolls around, we start hearing from the financial press that corporate earnings are coming in “unexpectedly” strong, or that a majority of companies have topped earnings estimates. Shocking. The financial press conveniently fails to mention that for the last twenty years the percentage of companies reporting positive earnings surprises has been rising steadily. And that in every quarter for the last 14 years, a majority of companies have topped estimates.

You would think that investors would begin to catch on, but based on the pop in many stocks following an earnings beat, apparently not enough have gotten wind of how the game is played.

Amazon.com is a case that caught my attention this earnings season. The headline for the first quarter earnings report from Amazon read “Amazon has blowout quarter.” Amazon isn’t a stock we follow closely at Young Research, but it is one of the nation’s largest retailers so it can be a bellwether for consumer spending. Following the “blowout” earnings report, Amazon shares surged almost 15%.

A 15% gain is a strong reaction to an earnings surprise—even if it was a blowout quarter. Looking closer at the results, Amazon topped sales estimates by about 2% and earnings estimates by about 26%. The 2% revenue surprise isn’t something most investors would consider a blowout quarter, but the earnings beat was impressive, or so it seemed on the surface.

Amazon reported revenue of $13.185 billion in the first quarter and net income of $208.4 million. Analysts were forecasting earnings of $176.3 million, so Amazon earned about $32 million more than expected. A $32 million earnings beat is far from a blowout for a company with over $13 billion in revenue. It is equal to only 0.24% of revenue. Management could have easily engineered the earnings beat by shifting expenses to next quarter or making minor expense cuts.

Don’t let the market suck you into the quarterly earnings con job. Stock prices tend to overreact to short-term news. This is especially true during earnings season. Stay calm and calculating, and maintain a long-term focus.