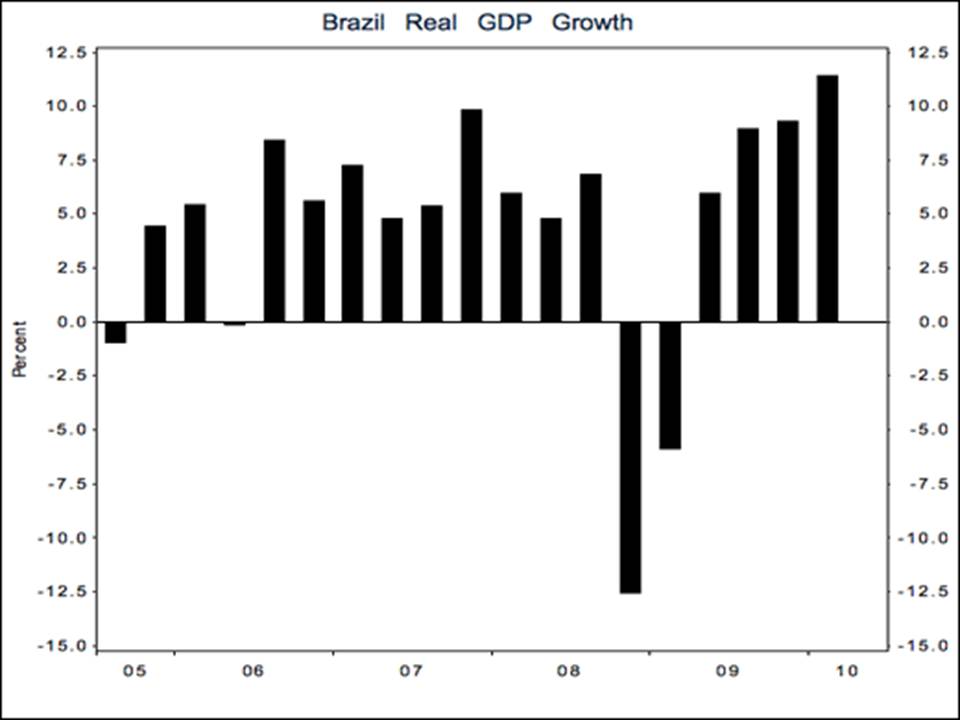

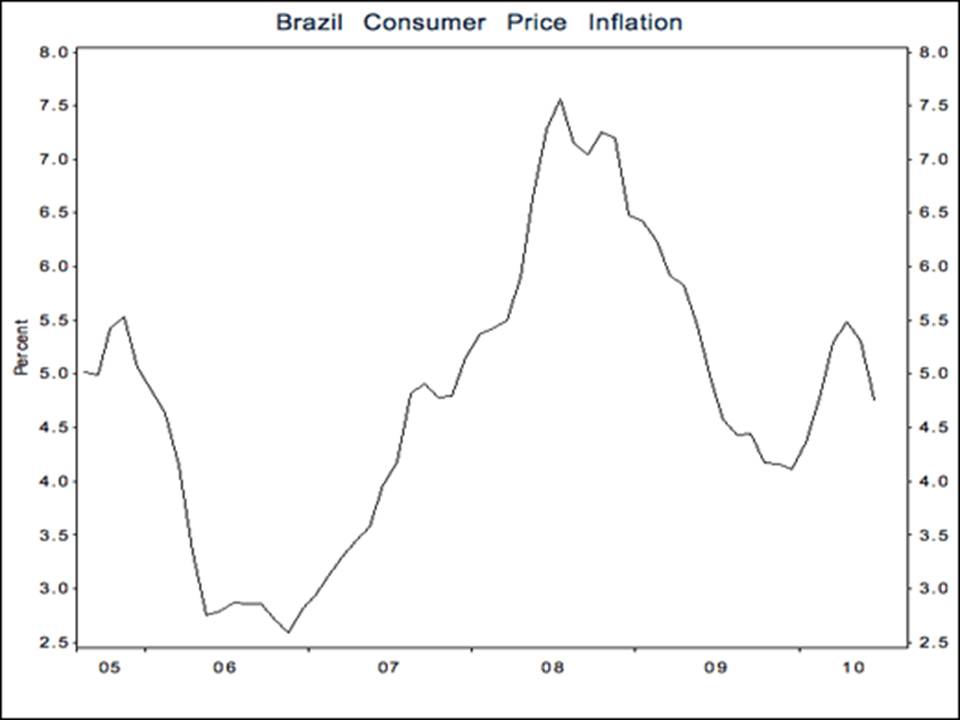

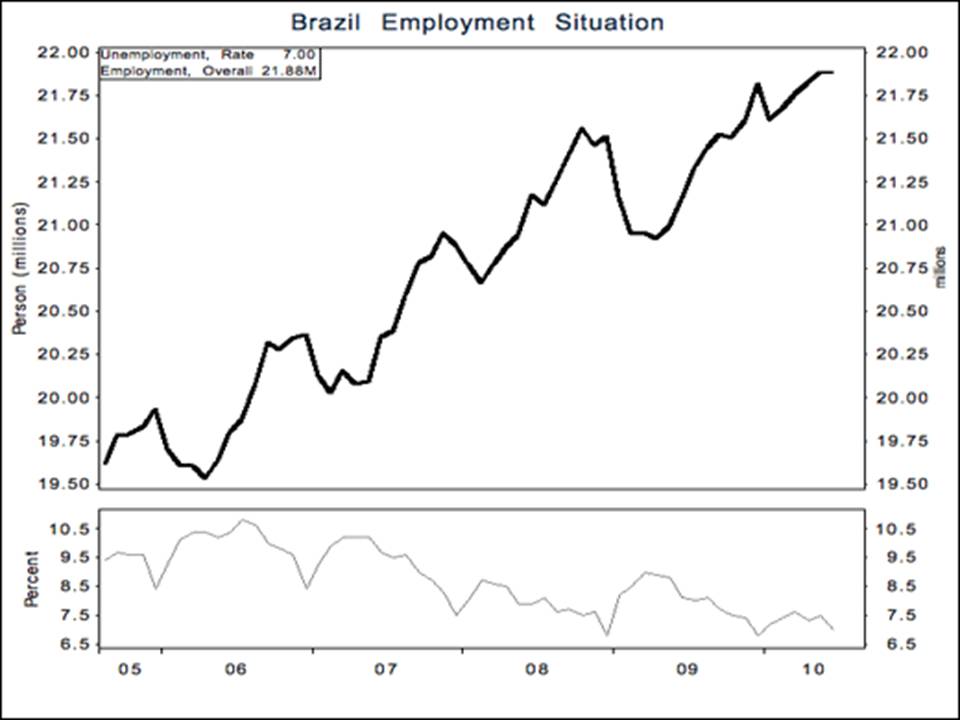

The economic recovery in Brazil continues to gain momentum. Brazilian GDP grew at 11.4% in the first quarter of 2010. Inflation remains tame by Brazilian standards at less than 5%, employment is up smartly, unemployment is at a record low, and consumer confidence is near pre-recession highs.

Contrast the strong performance of Brazil’s economy to the record high unemployment, record low employment, and very low consumer confidence in the U.S., and it quickly becomes apparent that investors need to broaden their investment horizon beyond the U.S.

Diversification across sectors and market capitalizations is simply not enough. Your portfolio should be well diversified across asset classes including currencies, gold, domestic and international equities and bonds, including non-U.S. dollar denominated bonds.

Take a look at the first chart here. Brazil’s GDP is growing at faster and faster rates signaling strong recovery from its recession at the end of 2008.

In the second chart you’ll see that the recession may have actually helped cool Brazil’s inflation, as it was getting caught up in the worldwide cycle of price increases.

In the third chart you can see that unemployment in Brazil has fallen to near record lows and employment is at a record high.

In the final chart you’ll see that having jobs and dependable pricing might be having an effect on the mood of Brazilians, as their confidence is nearing record highs.

Don’t fall prey to diversification models that focus on market caps and value/growth indicators. In today’s globalized economy you have to think broader than that. Young Research’s Global Investment Strategy provides investors detailed information on investing worldwide.