A client shared this story with me last week: In 1935 Grace Groner purchased three shares of company stock in Abbott Labs. 75 years later, thanks to the power of compound interest, her three share purchase was worth $7 million.

Grace Groner lived nearly her entire life in Lake Forest, Illinois, about 45 minutes north of Chicago.

After graduating from Lake Forest College in 1931, Grace was hired as a secretary at Abbott Laboratories, where she worked for more than four decades.

Grace never earned an amazing salary as a secretary. According to the Los Angeles Times, she got her clothes from garage sales. She lived in a one-bedroom house that was willed to her when a friend passed.

But in 1935, a few years after she started her job at Abbott Labs, she bought three shares of the company’s stock for about $60 per share. Her total investment was under $200.

Grace never sold those shares. Through dividends, share splits, and dividend reinvestment, when she died in 2010, her three share purchase was worth $7 million. She left it all to her alma mater.

The two most important lessons from this story?

A) She started with $200.

B) She took advantage of the power of compounding — for 75 years!

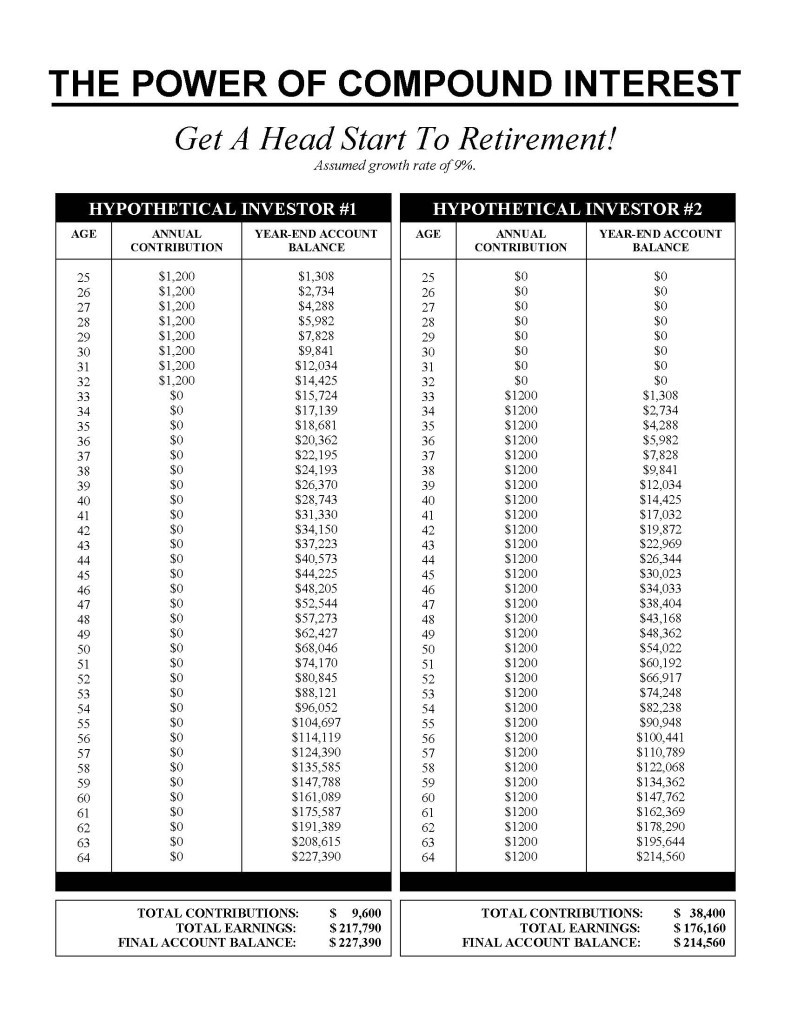

Compounding is often referred to as “magic” because it is one of the most fundamental ways to build wealth, yet takes the least amount of effort.

Compounding is simply earning interest on interest or dividends on dividends.