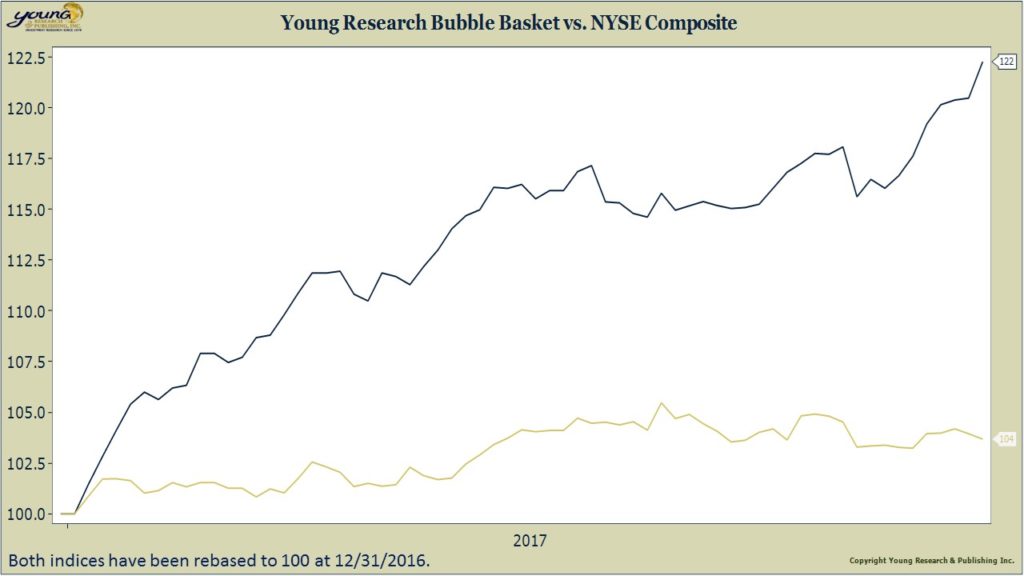

Stocks overall had a strong first quarter, with the S&P 500 gaining 6%, but it is the FANG stocks and shares of similar companies that performed best over the last three months. In the chart below we show the YTD performance of the NYSE composite index relative to the Young Research Bubble Basket. Our bubble basket is an equally weighted index of Facebook, Amazon, Apple, Netflix, Google, and Tesla. The bubble basket is up over 22% YTD compared to a 4% gain in the NYSE composite.

Raging bullish sentiment among the investing public and compelling stories from many of these firms are no doubt driving the parabolic gains. But investors have pushed the prices of many of the stocks in our Bubble Basket to levels that, to be kind, make them extremely vulnerable to any sort of misstep.

Conservative investors and those in or nearing retirement should stay far away.