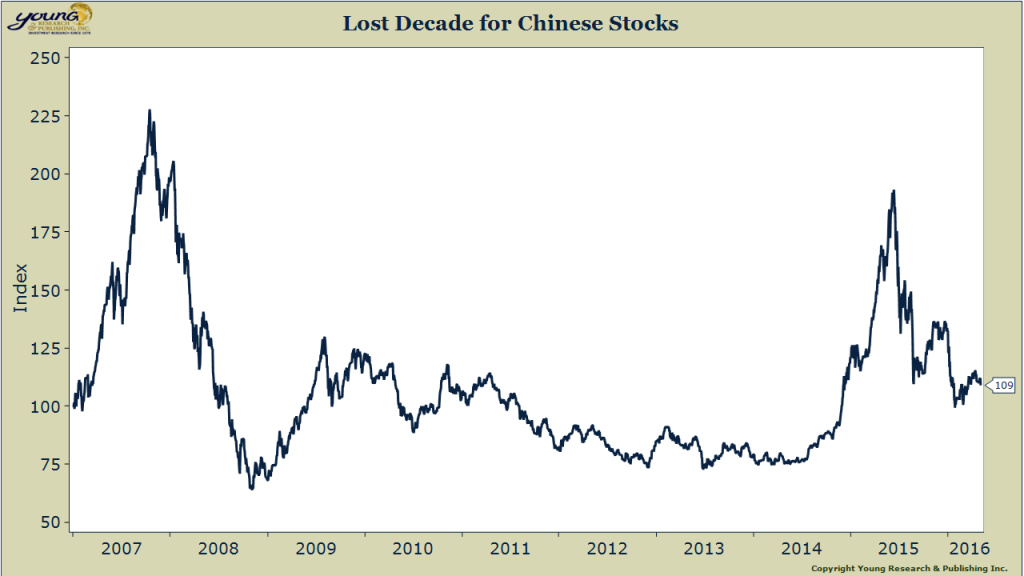

Over the last decade, China has been viewed as the world’s economic growth engine. And rightly so if you believe the country’s economic statistics. Nominal GDP has more than tripled over the last ten years. How have Chinese stock investors fared over this period? Not so well. Chinese shares have gone almost nowhere since year-end 2006 (12/31/2006 = 100 on chart). Growth ≠ Returns.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023