Bloomberg is reporting on the sell-off in high-yield bond ETFs (see here). Volume is soaring and prices are plunging. Part of the problem is the new structure of the high-yield bond market.

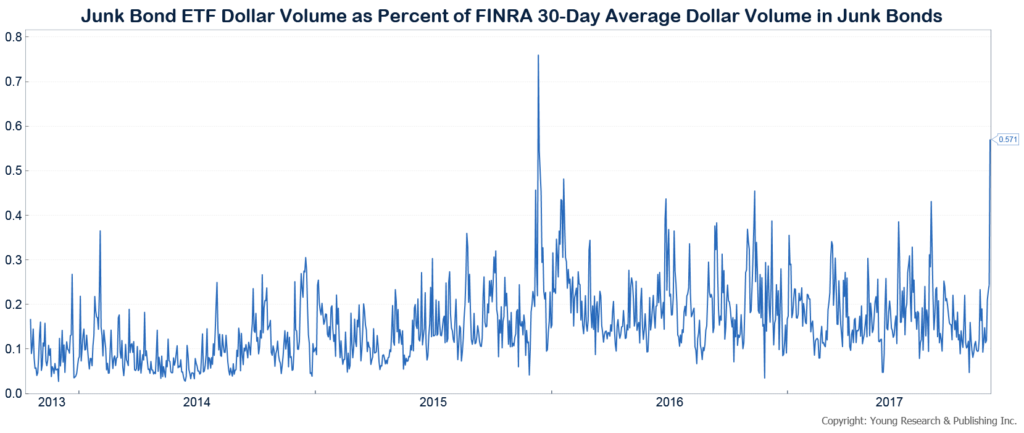

High-yield bond ETFs have become the tail that can wag the dog. Yesterday, the dollar volume of the four big high-yield bond ETFs spiked to over 57% of the average traded value of the total high-yield bond market.

The fast money crowd as well as yield chasers are the driver here. The fast money crowd favors junk bond ETFs over individual bonds because they are believed to have better liquidity.

And while there may be some truth to that in calm markets, when everybody rushes for the exits, that liquidity dries up fast.

There is a mismatch between actual liquidity of junk bond ETFs and perceived liquidity. Not a good combination and one that could lead to some ugly scenarios under the right circumstances.

For long-term income investors, individual bonds and open-end mutual funds remain the better approach.