Part I

Part I

I was there from the start. In early August 1971, I had just joined internationally focused research and trading firm Model Roland & Co.

On 15 August 1971, President Nixon shocked the world by announcing that the U. S. would no longer officially trade dollars for gold. At that time, gold’s fixed price was $35/oz.

By 1980, gold would hit an astronomical $800/oz.

OK then, back to Model and the firm’s wonderful head partner Leo Model. From my first day onboard at Model, I started covering a bevy of major Boston institutional accounts. I was 30 years old, and I would become friends with analysts, portfolio managers and traders at Wellington Management, Fidelity Investments, First National Bank of Boston, State Street Bank, State Street Research, Endowment Management, Studley Shupert, and Keystone Management through my entire investment career on Federal Street in Boston.

I immediately realized that international trading (including gold shares and arbitrage), as well as monetary strategy and world currencies, was going to be my focus from August 1971 onward.

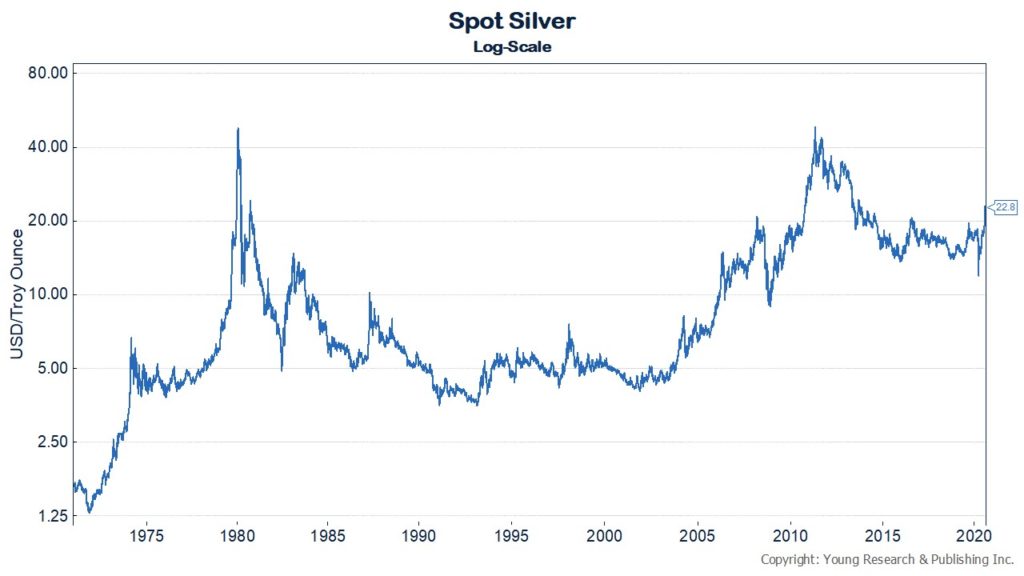

Five decades later, these subjects remain today my daily focus. I have been a buyer of gold, silver, and Swiss francs for decades, and I have never sold a single one of my positions.

By 1972 I was off to London on a mission for Leo Model. My job was to produce a strategy report for Model, Roland & Co on the international gold shares market. It took eight days in London to meet all the insiders with whom Mr. Model had arranged visits. Except for a single, most unpleasant glitch, (understatement) all went well.

I went on to submit a 25-page strategy report to Mr. Model. Shortly thereafter I was informed that Mr. Model had sent my report along to the firm’s chief monetary guru, one Edward M. Bernstein, one of the architects of the Bretton Woods monetary agreement.

Remember, I was 31 years old, and quite terrified to hear that EMB had been brought into the loop.

On 7 August 1972, I received the surprise of my young life: EMB wrote back on his corporate letterhead:

I think the collection of papers on gold is excellent. It seems objective and pointed. I have no suggestions. Put me on the list to get what you put out on gold.

Sincerely,

Edward M. Bernstein

Although I did not know it at the time, a year later, I would no longer be at Model, Roland.

Check back in with richardcyoung.com for my introduction Part II and the kickoff of our industry-leading precious metals, currencies, monetary madness, fed maleficence and dollar destruction weekly update.

Warm regards,

Dick