Nestle is adding to its coffee business with an acquisition of the high-end coffee roaster and retailer Blue Bottle Coffee. The Wall Street Journal reported on it here. The acquisition is a small one for Nestle, but it is a savvy move to remain competitive and relevant in the food business.

Change is afoot in the packaged foods industry. Brands that have dominated the industry for decades are under assault. Changing consumer tastes and shifting media consumption patterns are eroding the competitive position of branded packaged foods companies.

Nestle’s Strategy for a New Environment

As the world’s largest food company, Nestle isn’t sitting idle. The Blue Bottle Coffee acquisition is one of a number of strategies Nestle has deployed to protect its competitive position. Other savvy moves include the recent acquisition of Freshly, a meal delivery service, and Sweet Earth, a vegan and vegetarian products company. Nestle is also exiting businesses that are falling out of favor with consumers, like the company’s U.S. confectionery business.

Nestle’s focus for the future is on coffee, infant nutrition, bottled water, pet care (a business we like), and consumer health.

A History of Innovation and Success

Switzerland based, Nestle traces its origins back to 1867 when Henri Nestle created a “milk food” (baby formula) to save his neighbor’s baby. Nestle’s company was bought by Jules Monnerat in 1874, and the company has been making savvy acquisitions like Blue Bottle Coffee, Freshly, and Sweet Earth to innovate and reinvent itself ever since.

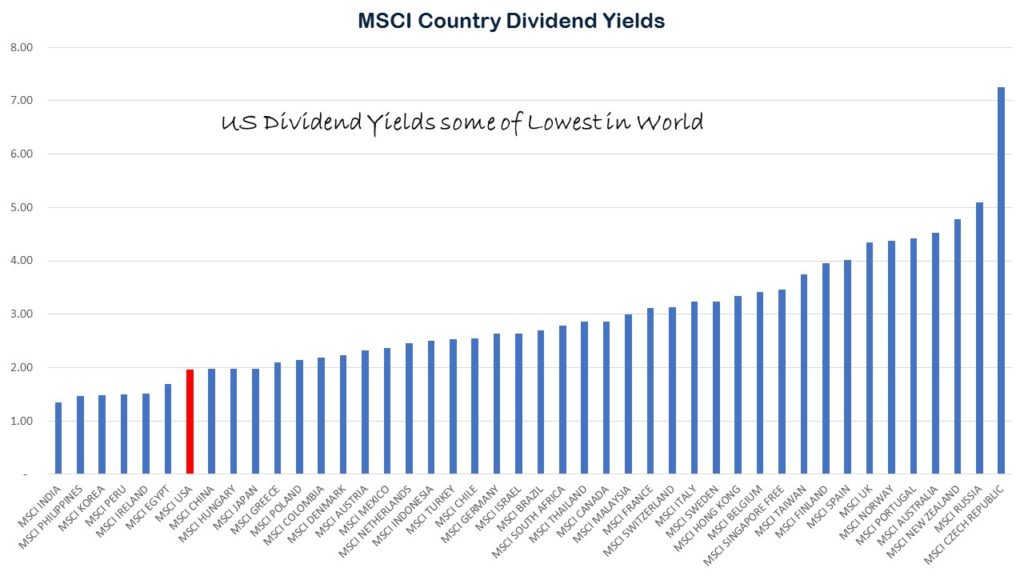

Dividend Investors Must Go Global

If you are a dividend or income investor, you want to focus on the foreign shares area of the market. Many foreign markets have dividend yields much higher than those available on U.S. stocks. The chart below shows the dividend yields for each country in the MSCI emerging and developed market indices.

One of the challenges self-directed investors face when trying to buy foreign dividend stocks is sourcing a reliable pricing and fundamental database to do proper investment analysis. The data isn’t available free on the Internet like it is for U.S. stocks. Expensive institutional-grade databases are required for such work.

Fortunately, Young Research subscribes to two of the top institutional financial and economic databases in the world. The combination of both, provides us with the ability to offer insight and analysis on every foreign dividend stock you might be interested in purchasing.

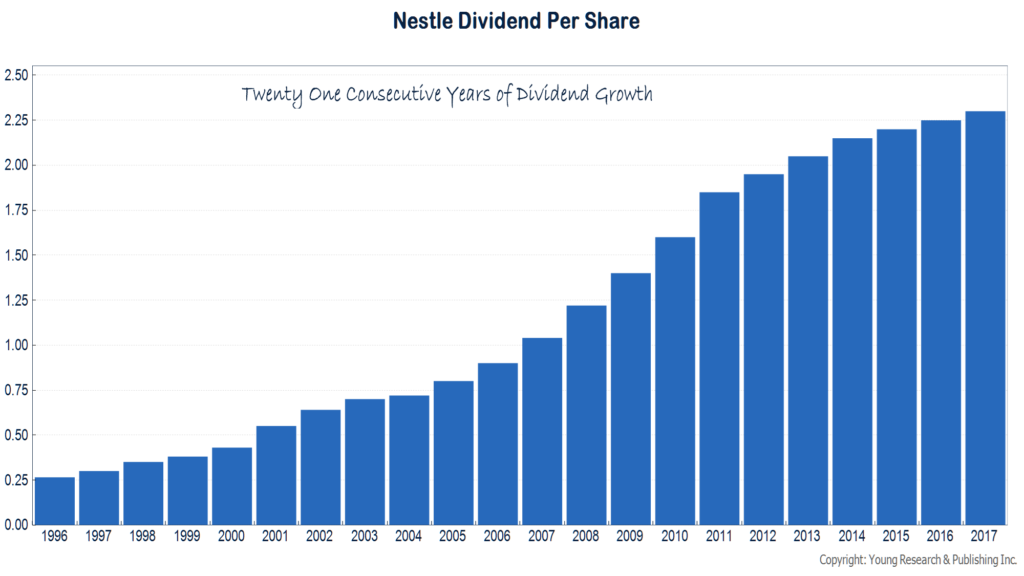

Nestle a Foreign Dividend Powerhouse

Our database shows that Nestle has paid a dividend every year since 1954 and has increased that dividend for 21 consecutive years. Over the last ten years, the dividend has compounded at over 8% per year. At today’s price, Nestle shares yield about 2.9%. Not a bad growth rate and yield for the world’s largest consumer staples company and one of the most conservative global stocks investors can buy.

Nestle is the type of dividend stock that we advise Richard C. Young & Co, Ltd. to buy as part of our exclusive agreement to provide research for the firm’s Retirement Compounders® Investment Program.

P.S. Did you know that Young Research is the exclusive research provider to Richard C. Young & Co., Ltd., one of the Top 100 Investment Advisors in the country according to Barron’s? (2012-2017) Disclosure Our research helps Richard C. Young & Co., Ltd. craft high-yielding dividend portfolios for conservative investors and those in or nearing retirement. You can learn more about Richard C. Young & Co., Ltd. here and you can read the firm’s latest private-client advisory on the global investment landscape here.

P.P.S. After a nearly four-decade hiatus, Young’s World Money Forecast (YWMF) is back. In its new re—invigorated digital format, YWMF covers the 30 Stocks in the Dow Jones Industrial Average including Dick’s short-term Bull & Bear Portfolio. You can read Dick’s latest investment analysis at www.youngsworldmoneyforecast.com.