As goes General Motors, so goes the nation was a phrase from years ago that spoke to how much impact General Motors business had on the U.S. economy.

While GM doesn’t have the same influence that it once did in the U.S. economy, auto sales still play a big role in economic cycles. That is true for the U.S. economy as well as for the global economy.

Today, the more appropriate phrase might be as goes Chinese auto sales, so goes the global economy. China is now the world’s largest auto market with annual passenger sales topping 20 million units. China is also the world’s second largest economy and it has been a major driver of global growth in recent years.

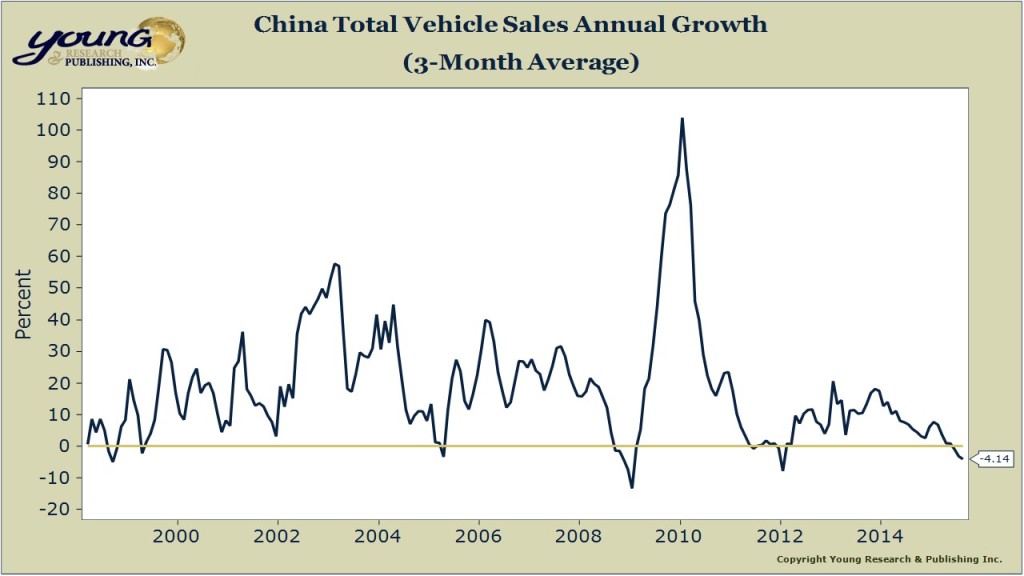

So when you see a chart like the one below that shows Chinese auto sales contracting, there is cause for concern. If slumping Chinese auto sales are in fact signaling more trouble to come for the Chinese economy, you can expect slower global growth as well as some additional financial turbulence. Is your portfolio prepared for such a scenario?