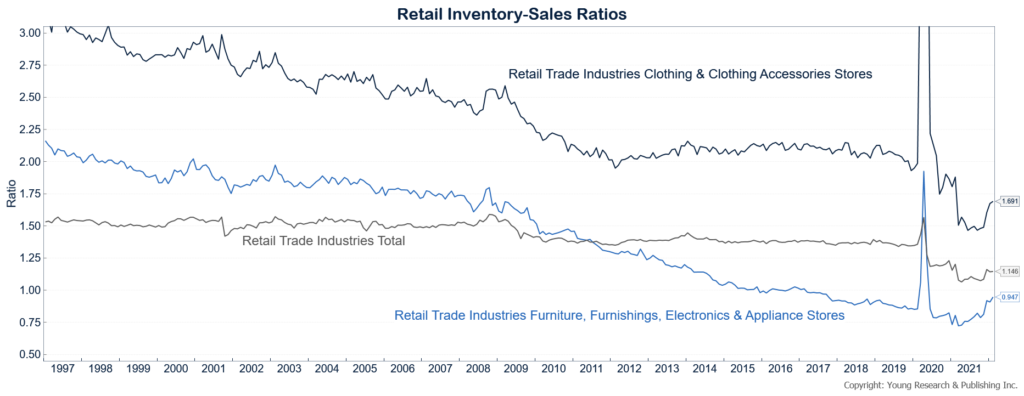

Every retailer’s worst nightmare is holding too much inventory in products that are no longer in demand. Inventory management is important at the national economy level too, as bloated inventories can lead to less production which is what makes up economic growth. Inventories overall still look low, but there are a couple of sectors where they have popped and could be troublesome based on recent headlines.

Paul Page writes in the WSJ’s Logistics Report:

The notorious bullwhip effect is playing out in real time in America’s stores. Retailers in their earnings this week have reported a surge of inventory as they found themselves carrying too much stuff that is no longer in high demand. The WSJ’s Jinjoo Lee reports goods like basic apparel, home appliances and furniture have piled up even as consumers have pivoted to services and to dressier office clothing, suggesting that the price-slashing sales that merchants fear may be on the way. For the retailers, the market is looking increasingly like a textbook example of the bullwhip effect, in which companies scale up quickly to meet new demand only to see the market turn downward just as fast. Walmart and Target saw inventory swell by 32% and 43%, respectively, last quarter. Kohl’s is forecasting flat or 1% sales growth but its inventory was up 40% last quarter.