The monthly employment report was released today. The headline payroll number in the employment report is probably the most overrated economic indicator released each month. Investors put far too much emphasis on a monthly data point that is revised twice in the following two months and then again once every year.

In an economy with over 140 million workers, the Bureau of Labor Statistics attempts to determine how many jobs were added each month. Then it guesses at how many were added at businesses that it doesn’t survey, and layers on top of that a seasonal adjustment that again skews the numbers to divine an estimate of the number of new jobs created each month. With monthly job gains averaging between 100K and 200K, the BLS is making estimates out to the fourth and fifth decimal point. And the margin of error is off the charts.

Take the current jobs report for example. According to Bloomberg, the average estimate for job gains in August was 230K with a high estimate of 310K and a low estimate of 190K. The margin of error on the monthly jobs report is 100K. So in statistical terms, if the average estimate is 230K, investors should be indifferent between an actual number of 130K or 330K. But they never are.

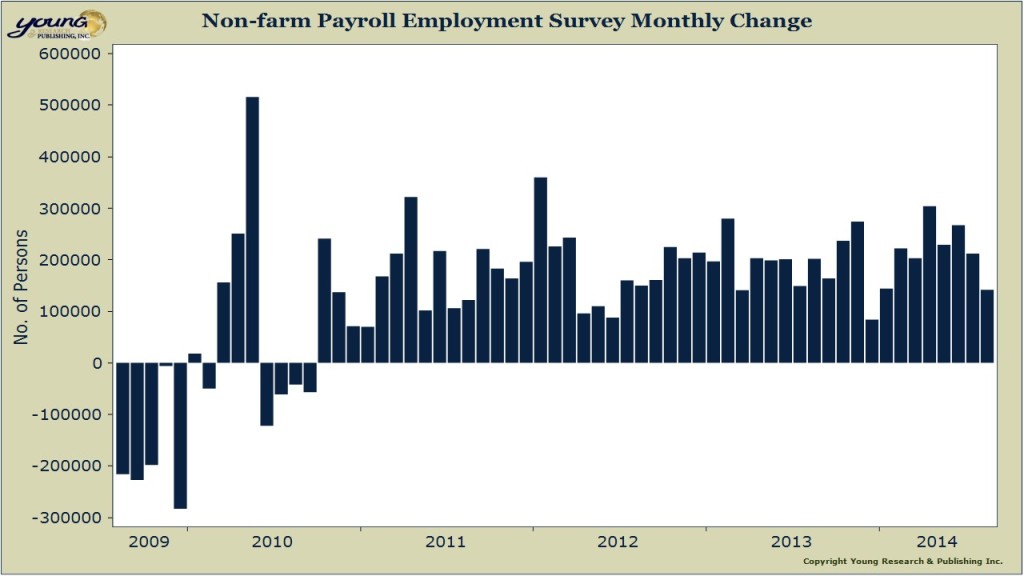

The August payroll employment gain came in far below estimates at 142K, but still within the margin of error from the consensus estimate. How did investors react? They bid up bonds and stocks in a fury as if the August payroll numbers actually provide any insight into the strength of the labor market. They don’t.

We could easily see an upward revision of 50K or 100K come this time next month. What will traders and speculators do then?

The monthly payroll report is more noise than signal. Long-term investors could serve themselves well by ignoring the monthly release and focusing only on longer-term trends in jobs growth.