The latest GDP report came out yesterday and it showed economic growth of 2.3% in the second quarter. First quarter GDP was revised up from a drop of .2% to a gain of .6%. Yesterday’s release also included the BEA’s (Bureau of Economic Analysis) annual revisions to GDP. The annual revisions incorporate newly available, more accurate, and more complete source data.

What did the revisions show? This won’t come as a surprise to Mom and Pop on Main Street, but economic growth over the last few years was weaker than originally reported. The compounded annual growth rate of GDP from 2011-2014 was revised down to 2% from 2.3%.

The biggest downward revision (-.7%) came in 2013—the height of the Federal Reserve’s most aggressive bond buying program in history. Way to go Ben and Janet!

It was also noteworthy that GDP growth in the third quarter of 2012—the quarter just prior to Obama’s reelection—was revised down to a dismal 0.50% from an originally reported 3.1%. Probably just a coincidence though. 😉

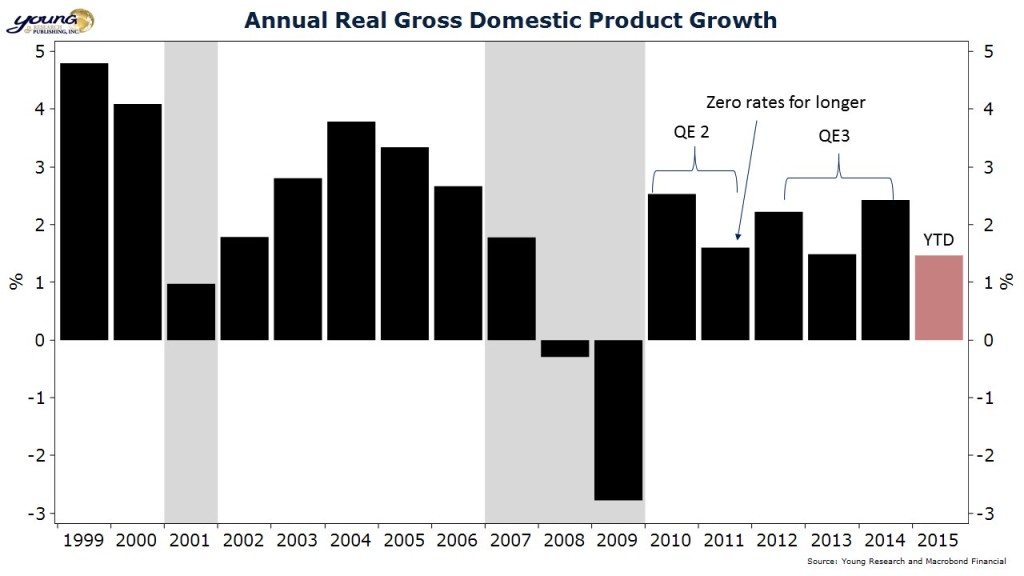

My chart below shows growth in annual GDP since the recovery began. Since the recovery started, we haven’t broken through 3% growth in a single calendar year. The highest rate of growth achieved in any calendar year was a depressing 2.5%.

If Yellen & Co., were looking for an excuse to further delay an increase in interest rates, the BEA’s annual revisions just came to their rescue. To the Fed’s way of thinking at least. With years of evidence now under our belts, it is hard to see any benefit to the real economy from zero percent interest rates and trillions in money printing.

As you can see on my display, in the year following the Fed’s QE2 program, economic growth actually sank instead of increasing. And during the height of the Fed’s QE3 program, the economy experienced the worst growth rate of the recovery. Sooner or later, the Fed is going to have to come to terms with the fact that money printing does little for the real economy and that a prolonged period of zero interest rates may do more to harm growth than stimulate it. This may sound counterintuitive until you consider the impact that prolonged periods of zero rates can have on lending decisions—the most powerful mechanism for transmitting monetary policy.

The bottom line for investors: the GDP revisions likely give the Fed an excuse to further delay a rate hike. Whether or not they take the bait is still to be determined. Stay attuned here.