It’s that time of year again, when portfolio managers who are trailing their benchmarks throw well-crafted investment plans out the window and start chasing the market higher. The goal for this short-term focused crowd is to have a higher return than the market by the time of close of business on New Year’s Eve.

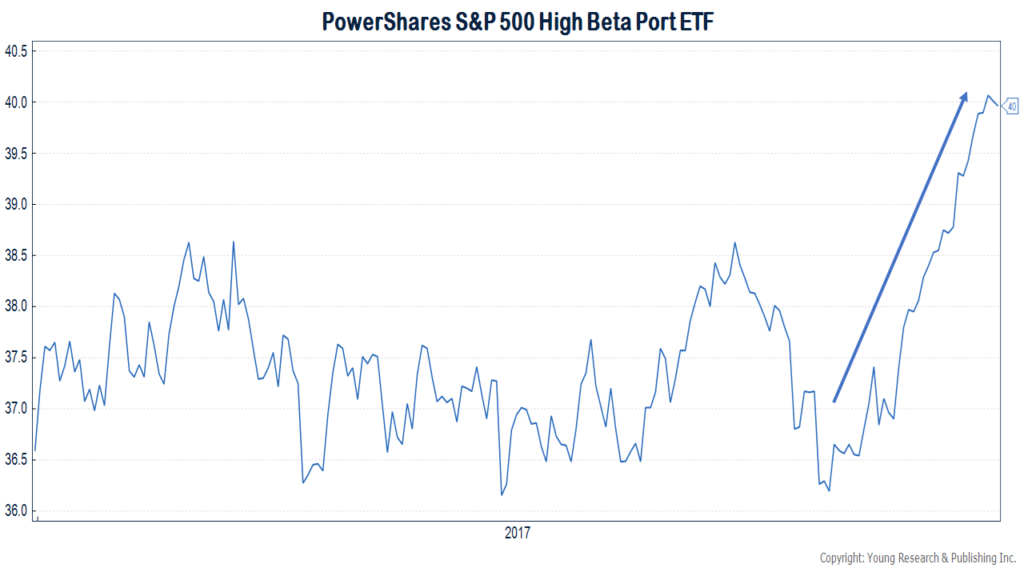

The PowerShares High Beta ETF is your evidence of this shameless practice.

High-beta stocks are stocks that tend to move up or down more than the broader market. If a stock has a beta of 1.5 for example, one would expect this stock to rise 1.5% for every 1% rise in the S&P 500. Over the last month, Beta has been in favor as fund managers try to make up lost ground. The PowerShares High-Beta fund is up over 10% compared to a 4% rise in the S&P 500.

What type of stocks make up the high-beta sector of the market? A quick glance at the PowerShares ETF shows the likes of United Rentals, Advanced Micro Devices, CarMax, Western Digital, and E-Trade among the fund’s holdings.

Probably not a who’s-who of stocks for retired and soon to be retired investors. If you are retired, or soon to be retired, stay focused on your own goals and your own objectives. Relative performance comparisons often lead one to make emotionally charged decisions that can sabotage investment plans.