If your portfolio isn’t properly diversified, the answer is a lot, but even if you craft a diversified equity portfolio your losses can be substantial. How substantial?

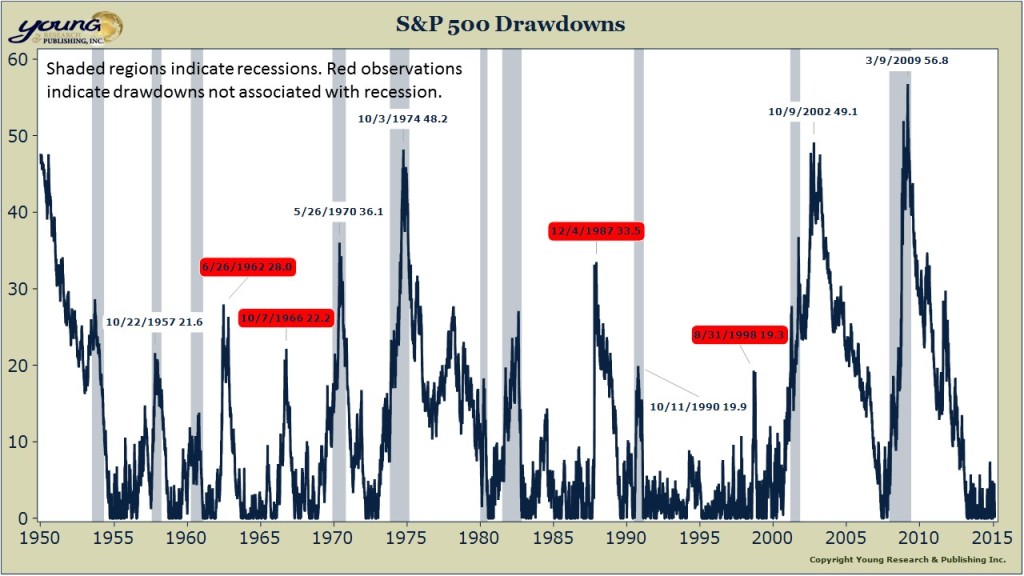

Most would agree than an S&P 500 index fund qualifies as a diversified portfolio, so let’s look at the maximum losses sustained on an investment in the S&P 500. In the chart below, I show the drawdowns of the S&P 500 (not counting dividends) over the last 65 years. Drawdown sounds a bit jargony for a Friday.

What does it mean?

A drawdown is simply the maximum loss on a portfolio or an index from the prior high. So for example, let’s say your portfolio is worth $100 today (okay so you’re a spendthrift). Now assume that your portfolio loses 25% over the next quarter, then gains 25%, then loses another 30%. Your portfolio will be worth $65.62 at the end of period three. Your drawdown is about 34%.

The biggest drawdowns in the S&P 500 over the last 65 years have been associated with recession and they have been on the order of 50%. I could go back farther on the chart to show the drawdown during the 1930s (over 85%), but my goal is not to send you into a deep depression. I want to keep you sober to the risk of an all stock portfolio. Six years into a bull market that won’t quit, complacency starts to set in. Greed and envy lead to the types of decisions that can sabotage long-term performance. If you are in or nearing retirement the stakes are even higher. You don’t have the time to make-up for big losses. If your portfolio falls 50% the year before you retire, your standard of living is going to be much lower during retirement. Stay vigilant.