Earlier this week the WSJ ran with a headline asking if Value Investors face an existential crisis. See here. The NY Times also featured a piece on the difficulties of value investing. Below are some of the highlights.

Think value investors have it tough these days? Just ask William J. Nasgovitz, portfolio manager of the Heartland Value fund, whose own mother recently tried to pull her money out of the fund.

“My mom wanted to buy Walgreen at 50 times earnings and sell out of the value fund after making six times her money,” Mr. Nasgovitz said. ”It’s a great company, but it isn’t worth 50 times earnings.”

He eventually persuaded his mother to stay put. Recently, however, his son Will admitted to buying an index fund. ”Another little dagger,” Mr. Nasgovitz said.

And there are many more. ”Clients, consultants and advisers are all tired of talking value,” he said. ”They want action.”

”Action” in this case really means one thing: big growth companies and the funds that invest in them.

…

But that has lately brought grief for their shareholders, as stocks relatively cheap by traditional measures continue to be clobbered by the big growth companies that have paced the enormous run-up in the Standard & Poor’s 500-stock index.

…

Some managers think that with the advent of a new, technology-driven economy — where economic cycles are far longer than they have been in the past — it could be many years before value stocks return to favor for an appreciable period.

…

Growth stocks were driven up further, they say, by what is sometimes called ”closet indexing” — the purchase of the largest-capitalization stocks in, say, the S.& P. by active fund managers. Some managers moved into these big growth stocks simply because they grew tired of missing out on the market’s momentum.

…

”As always, when a strong trend has been in place for a few years, there is no lack of people who rationalize why what has been true will continue to be true — in other words, that value, and particularly small value, will never come back,” Mr. Eveillard said. ”If I thought so, I would retire.”

Our savvy readers will likely recognize that the NY Times article was written almost two decades ago in April of 1999. You can read it here.

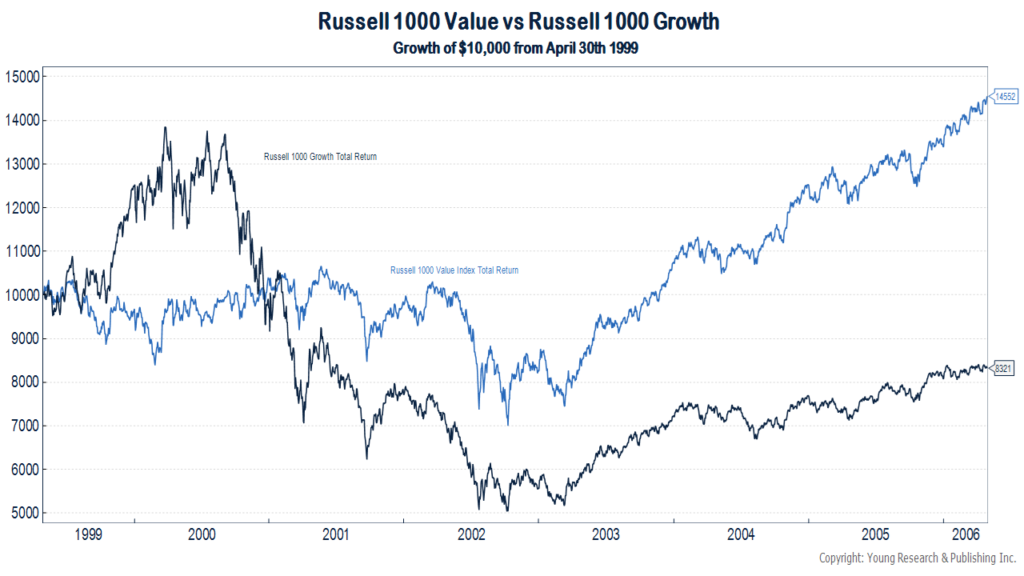

What motivated the NY Times to write a piece like this near the height of the dotcom bubble? The same thing that motivated the WSJ to write a similar piece this week—misguided relative performance comparisons. Those investors who abandoned value in April of 1999 to chase growth, looked smart for a few months, but over the subsequent 7 years, value crushed growth (see chart below).

Over the long-run a value conscious approach is likely to beat a strategy based on glitz and glamour.