In the short-run, sentiment matters as much if not more than fundamentals. In the long run, it is fundamentals that win out.

The push and pull between sentiment and fundamentals drives many investors to make emotionally charged decisions that sabotage portfolio performance.

Stocks can climb higher slowly over a period of years and then crash suddenly, wiping out years of gains. Take the NYSE Composite Index as an example, because–let’s face it–the S&P is no longer representative of a broad portfolio of stocks.

From year-end 2012 through February 12, 2020 (7+ years), the NYSE composite gained 7.2% annually. From February 12 to March 23 of this year, the index fell 38%. Seven-plus years of gains were wiped out over the course of a few weeks.

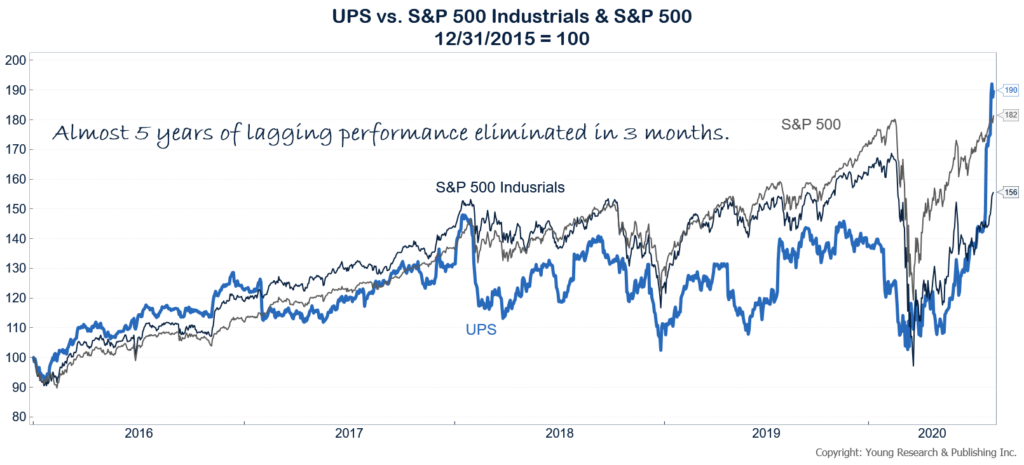

The same can happen in reverse. UPS is a stock we follow and invest in for clients. Over the last five years, UPS shares have lagged the broader market. See our chart below.

Wall Street wasn’t happy that UPS was investing so much into its business to meet rising demand. Rising demand always seemed like a good problem to have in our view. And we were happy to sit patiently earning a 3% dividend yield that was rising 5.7% per year. A 3% yield with 5.7% growth gets you to almost 9% in one of America’s big blue chips.

What’s wrong with that?

Nothing, it turns out, but for the better part of five years UPS shares languished. Then suddenly, in May, UPS shares caught fire. E-commerce demand has soared because of COVID and UPS is passing higher costs onto customers.

Wall Street loves that idea.

Since mid-May, UPS shares are up better than 70%. As you can see in the chart above, the stock is now ahead of the industrials sector and the tech-laden S&P 500 since year-end 2015.

The actionable advice here is to invest with patience. Stocks that languish can suddenly rebound when sentiment shifts, and stocks that never seem to quit can suddenly crash.