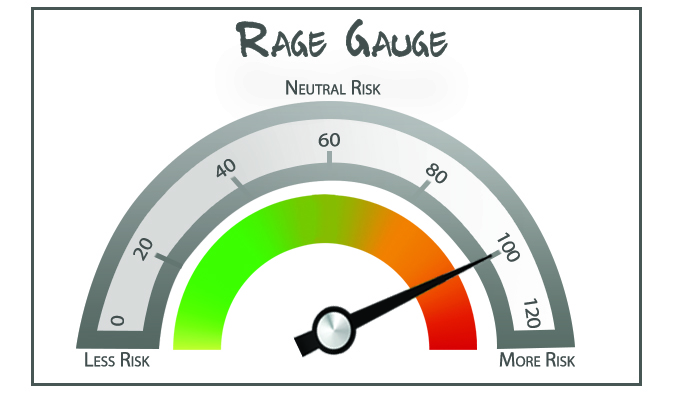

Your Survival Guy’s February RAGE Gauge is in, and it’s not terrible. Finally, we have some yields we can sink our teeth into, and dividend-paying stocks are getting more respect. That’s good. Plus, it’s an election year, and the Fed, a political beast, is aiming to please. But there’s plenty of reasons for concern, too. My RAGE Gauge is a tick lower, which leads me to another question to ask your potential advisor: How do you manage money in bad markets?

Your Survival Guy’s weathered some tough ones, mostly created by the bad behavior of others: the demise of the hedge fund Long Term Capital Management, the tech and real estate busts, and Covid, to name four. Everything was going just fine, and then, crack, the avalanche began without warning. Is there any other kind?

When I review prospective client statements (note the word prospective, because not everyone’s cut out for this), what I tend to see are trophy stocks. Stocks that have gone up in price and have been added to through the years while the ones that declined (often temporarily) were cut loose. That’s not investing to me. That’s hoping prices go up. To me, it needs to be about income.

When you focus on the stability of income, you’re in a unique position to unearth investments that are under the radar. But it’s not easy going against the grain. It’s hard to buy when others aren’t. Like I wrote above, not everyone’s cut out for it.

When investors own just a handful of trophy stocks, it gets more difficult to sell. They’re good at buying. Not so much with selling because knowing when to sell is hard. There can also be more taxes involved. And there’s the “greed” thinking about how terrible it will be if it doubles from here and all the money that was “lost.” Those are the emotions of money.

Action Line: I’ve never met an investor who likes selling the “winners.” That’s how trophy cases are filled. But it’s worth noting that trophies can only be so high. Let’s talk.

Originally posted on Your Survival Guy.