By ID1974 @ Shutterstock.com

As Amazon grows, and it aims to turn sales into profits, things are changing. Sometimes that means customers aren’t always getting what they thought they paid for. One Amazon Prime customer ordered a ladder and a different one arrived… broken. A month later, he was still trying to get a refund. Katherine Bindley explains what’s happening in The Wall Street Journal:

Mr. Arguello says the seller then told him that to get a refund, Mr. Arguello must destroy the ladder, so no one will get hurt using it. Though it wasn’t a Prime purchase, Amazon intervened after the Journal’s inquiry and refunded his money. Mr. Arguello says he might pay his friend another $40 to take the ladder to a landfill.

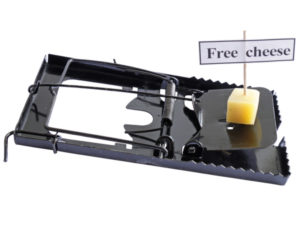

Such are the risks of operating on Amazon autopilot. After years of shopping success, you’ve come to expect any number of things that aren’t necessarily true: that every price you see is competitive, that Prime orders always arrive in two days, that Amazon’s Choice items are the best value and that returns and refunds are always a few easy clicks away.

After nearly purchasing a 75-ounce bottle of Cascade for $13 that Walmart sells for $6, I started looking into how not paying enough attention on Amazon can cost money and time. Here’s what I found:

What Two-Day Shipping Does (and Doesn’t) Mean

Amazon raised the annual price of its Prime program to $119 last spring. While there are various benefits, including streaming media and discounts at Whole Foods, many customers are in it for the two-day shipping perk. Lately, a lot of them are complaining that Prime no longer seems to mean two days.

Customers are naturally confused when in-stock Prime items show shipping estimates of four to five days or require an additional charge to arrive in two days. On the flip side, there are times when Amazon surprises customers with one-day shipping at no extra cost.

Amazon will also sometimes display one shipping estimate when you click on an item and a different one when you go to check out. When I viewed a recommended Prime product on a Monday, it said “Free shipping by Friday.” When I went to checkout (still Monday!), my earliest free-delivery window was the following Monday.

Read more here.