At Young’s World Money Forecast a few weeks back Dick wrote, “What we are looking at in 2017 is a “follow the leader” momentum based market move completely untethered from the long term anchor of dependable cash flow for shareholders.”

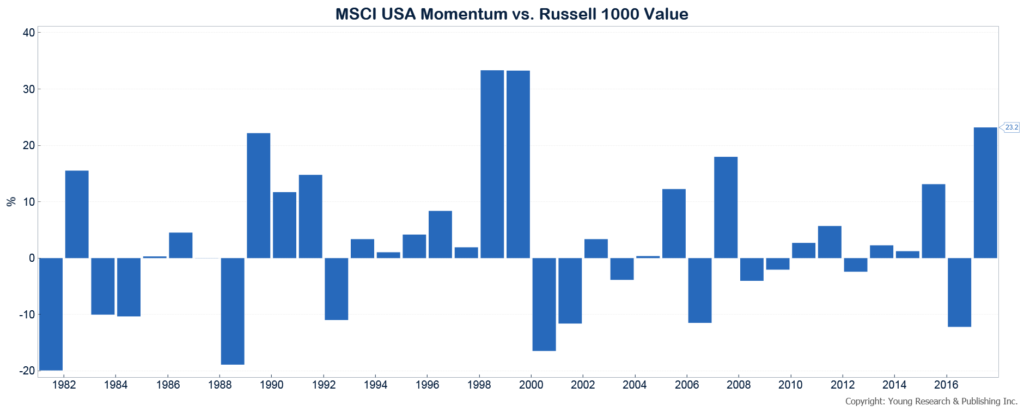

That was no joke. The chart below shows the difference in the annual return of the MSCI Momentum Index (follow the leader index) and the Russell 1000 Value Index (2017 return is YTD). This is only the third time in almost four decades that momentum has performed this much better than value. The only other occasions when a “follow the leader” strategy worked so well were during the speculative blow-off phase of the dotcom bubble. Otherwise known as the greatest stock market bubble in U.S. history.

The strong performance of momentum is both good and bad for long-term investors. Good in the sense that a wider spread indicates longer-term opportunities are being eschewed by traders, speculators, and performance chasers as they chase the best performing stocks higher and higher. There is always long-term opportunity to be found in the unloved, forlorn, and out of favor. Bad in the sense that the 1998-1999 experience shows these trends can carry on longer and suck in more folk than would seem possible to the investor who crafts portfolios on the basis of dependable cash flows. Dividends and cash flow remain at the core of our investment strategy and we would advise the same approach for all conservative, retired, and soon-to-be retired investors.