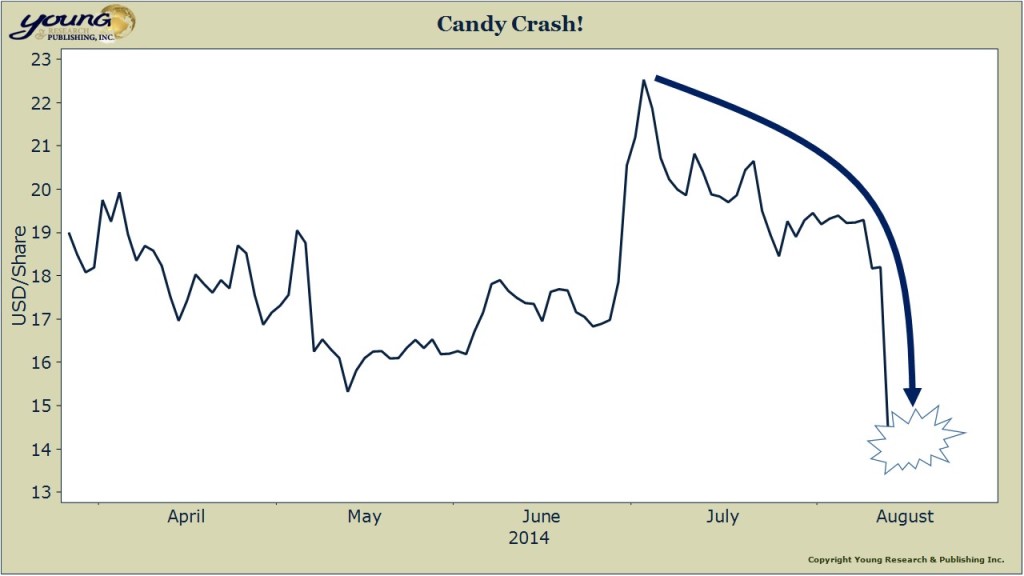

The only investing fad that never seems to go out of style on Wall Street is, well, fad stocks. King Digital Entertainment, maker of the popular…err getting less popular, Candy Crush Saga app is today’s poster boy for fad stocks.

If you aren’t familiar with Candy Crush Saga (you’ve dodged one of life’s great hardships), think of it like Angry Birds—lots of levels that get more challenging as you move higher—but less successful.

When is the last time you played Angry Birds?

Candy Crush is King Digital’s primary source of revenue. And it has been a big winner for the company. King Digital was able to pull off a $7 billion initial public offering on the back of its Candy Crush Saga success.

I was shocked when the company came public in March. This is a one-hit wonder with a revenue stream based on an obviously faddish product. Who would buy this?

In our premium strategy reports we advised investors to steer clear. Here is what we wrote about King’s IPO in the April issue of Young Research’s Global Investment Strategy:

How much is a one-hit wonder that could be bankrupt by this time next year worth? According to Wall Street math, $7 billion. That’s not a typo—King Digital pulled off a $7 billion IPO. Stunning, is it not? How did the bankers pushing King’s stock manage such a feat?

Greed. The hope of speculative gains has turned the IPO market red-hot. According to Renaissance Capital, the average one-day pop in IPOs in 2014 is 22%—the highest in over a decade. Investors participating in the King Digital IPO were hoping to make a quick buck, as they did with many of the other IPOs that came public in 2014. The King Digital IPO is emblematic of the bubble conditions that prevail in the stock market.

Earlier this week King Digital reported second quarter earnings that missed analyst estimates. The company also lowered its full-year growth outlook. Why the earnings miss and lower guidance? It would seem interest in Candy Crush Saga has peaked.

That sounds like a problem.

King Digital shares cratered 23% on the news even after the company tried to bribe shareholders to stick around by announcing a $150 million special dividend. Even with the stock now trading at 8X earnings, the shares remain expensive. Fad stocks are best left to traders and speculators.