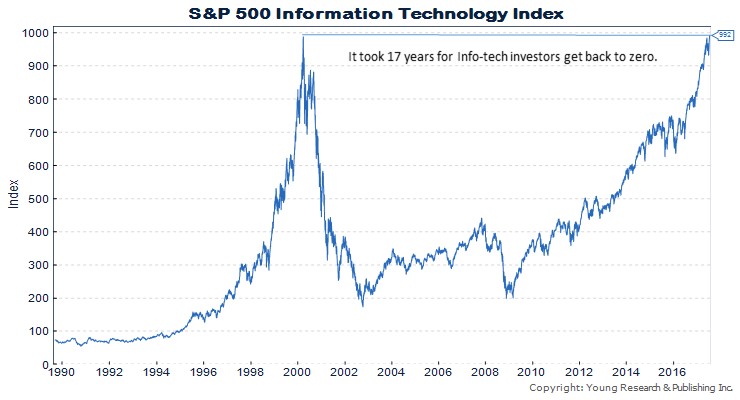

After nine straight days of gains, the S&P 500’s info-tech sector index has reached a new record, beating its previous peak set in 2000 just before the dotcom bubble burst. It has taken 17 years for tech investors to get back to zero if they were invested in 2000.

Leading the charge have been Apple and Google. Today Apple’s market cap is nearing $800 billion, and Google’s is nearing the $700 billion threshold. Driving the sector have been a relatively low number of stocks, frequently referred to here on Youngresearch.com as the “Bubble Basket.”

It hasn’t just been the info-tech sector that’s ridden these stocks higher, the entire S&P 500 index has been bolstered by them. It’s been even more apparent in the Nasdaq index. Amrith Ramkumar and Ben Eisen report at MoneyBeat:

Apple, the largest publicly traded company in the U.S., has posted its longest streak of consecutive gains since August 2014, while shares of other tech titans, including Facebook and Microsoft, closed at all-time highs. Google parent Alphabet, meanwhile, isn’t far from joining Apple as one of two companies with a market capitalization above $700 billion.

Those large tech stocks have carried the S&P 500 to new highs this year, attracting investors for their ability to increase earnings despite tepid economic growth.

Highflying semiconductor stocks that make the chips used in many technological products and other software shares have also outgained stocks in other sectors this year.

The tech-heavy Nasdaq Composite returned to setting fresh highs in the spring of 2015. On Tuesday, it set its first record since June 8 and reached another all-time high Wednesday, its 40th of 2017.

The S&P tech sector has been slower to reclaim record levels than the Nasdaq in part because it is missing some of the Nasdaq’s biggest gainers. Netflix and Amazon.com, though they are often associated with tech stocks and included in the Nasdaq, are classified by S&P as consumer-discretionary companies.

Read more here.