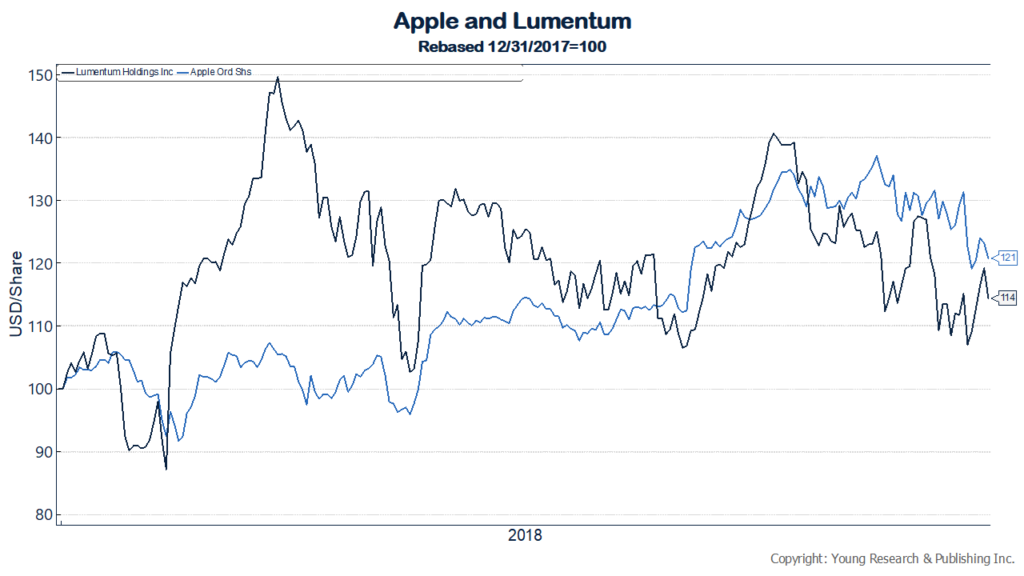

Lumentum, an Apple supplier, told investors it is cutting its outlook for the second quarter, possibly signalling that Apple’s business is taking a hit. Tech investors reacted by pushing Lumentum’s stock price down 30%, and Apple’s down 4.1%. Is it possible that Apple has raised prices too high for its products, thereby decreasing demand? Ryan Vlastelica reports for Bloomberg:

The latest warning sign was Lumentum Holdings Inc. cutting its second-quarter outlook after one of its largest customers asked to “meaningfully reduce shipments” for previously placed orders. Lumentum didn’t name the customer, but Apple is its biggest, according to Bloomberg supply-chain data. Shares of Lumentum plummeted a record 30 percent while Apple dropped as much as 4.1 percent. Oclaro Inc., which is being bought by Lumentum, lost 11 percent, on track for its biggest drop since April.

“We think investors should consider Lumentum’s updated guide as reflecting as much as a 30% cut in Apple orders,” Wells Fargo analyst Aaron Rakers said in a note to clients.

Loop Capital Markets also said the customer is likely Apple. The development “is not entirely surprising” but “it seems very likely to us that the market for 3D sensing-related light sources and other components is going to be smaller next year than previously anticipated,” analyst James Kisner said in a research note.

Among other Apple suppliers, Cirrus Logic Inc. dropped 10 percent at 9:49 a.m. in New York. Qorvo Inc. slid 7.3 percent, Skyworks Solutions Inc. fell 2.8 percent, Finisar Corp. dropped 4.7 percent and Broadcom Inc. fell 5.3 percent. Semiconductor stocks were broadly lower with the Philadelphia Semiconductor Index down 3 percent.

Read more here.